Brazil is one of the most dynamic and promising countries in Latin America for companies looking to hire in Brazil and build remote teams. As the region’s largest economy with a well-established tech ecosystem and a large, highly educated workforce, Brazil offers global companies a strategic opportunity to hire in Brazil with skilled talent while optimizing costs.

This guide provides everything you need to know to hire in Brazil—from salary benchmarks and hiring models to labor laws, compliance, and employment contracts. Whether you’re looking to hire a few remote engineers or establish a legal entity, this guide will walk you through the process step by step when you hire in Brazil.

Why Hire in Brazil

When you hire in Brazil, you combine a massive talent base, time zone alignment, and digital infrastructure to support global hiring needs.

Skilled Talent Pool

- Over 100,000 new technology graduates annually

- Strong university system with top programs in engineering, IT, and finance

- High volume of bilingual professionals, particularly in tech, marketing, and customer service when you hire in Brazil

Cost-Effective Salaries

- Salary levels 50–70% lower than in the U.S. for comparable roles when you hire in Brazil

- Lower operational costs in secondary cities like Recife, Curitiba, and Porto Alegre

- Significant savings on employment costs while accessing top talent

Time Zone Alignment

- Operates on GMT-3, overlapping with U.S. Eastern and Central Time zones

- Enables real-time collaboration with North American teams when you hire in Brazil

Remote Work Readiness

- Strong broadband coverage across urban areas (over 80% internet penetration)

- Mature remote work culture, especially in technology and digital services

- Professionals you hire in Brazil are well-equipped for remote collaboration

Cultural Compatibility

- Western business norms and strong alignment with U.S. corporate practices

- Adaptable, collaborative work style with high levels of creativity and innovation when you hire in Brazil

Government Support

- Investment in tech education and digital transformation

- Supportive programs through SENAI, SEBRAE, and state-level initiatives to boost innovation and entrepreneurship for companies that hire in Brazil

Key Market Stats When You Hire in Brazil

| Statistic | Details |

|---|---|

| Official Language | Portuguese (English proficiency growing, especially in tech and business roles) |

| Time Zone | GMT-3 (overlaps with U.S. Eastern and Central Time) |

| Currency | Brazilian Real (BRL) |

| Population | ~215 million (2025 estimate) |

| Internet Penetration | Over 80%, with strong infrastructure in major cities |

| Labor Force | ~110 million, with large talent pools in tech, finance, and customer service |

| STEM Graduates | ~100,000 per year |

| Major Talent Hubs | São Paulo, Rio de Janeiro, Belo Horizonte, Curitiba, Porto Alegre, Recife |

| Minimum Wage (2025) | BRL 1,500/month (approx. USD $300) |

| Remote Readiness | High—especially in tech, design, and digital service roles |

Top In-Demand Roles When You Hire in Brazil

Brazil’s workforce spans a broad range of professional skill sets when you hire in Brazil, with particularly strong representation in the technology, business services, and digital industries.

Software Development

- Front-end Developers (React, Angular, Vue)

- Back-end Developers (Node.js, Python, Java, PHP)

- Full-stack Developers

- Mobile App Developers (Android, iOS)

- DevOps Engineers

- QA Engineers and Testers

- AI and Machine Learning Engineers

- Blockchain Developers

Sales & Marketing

- Sales Development Representatives (SDRs)

- Account Executives

- Digital Marketing Specialists

- SEO/SEM Experts

- Social Media Managers

- Content Creators (copywriting, video editing)

Professional Services

- Accountants and Bookkeepers

- Financial Analysts

- HR Specialists and Recruiters

- Administrative Assistants

- Project Managers

Customer Support & Operations

- Customer Service Representatives

- Technical Support Agents

- Virtual Assistants

- Operations Coordinators

- BPO Professionals

Employment benefits play a crucial role in attracting and retaining top talent when you hire in Brazil, including health insurance, paid leave, and retirement plans under Brazilian labor law.

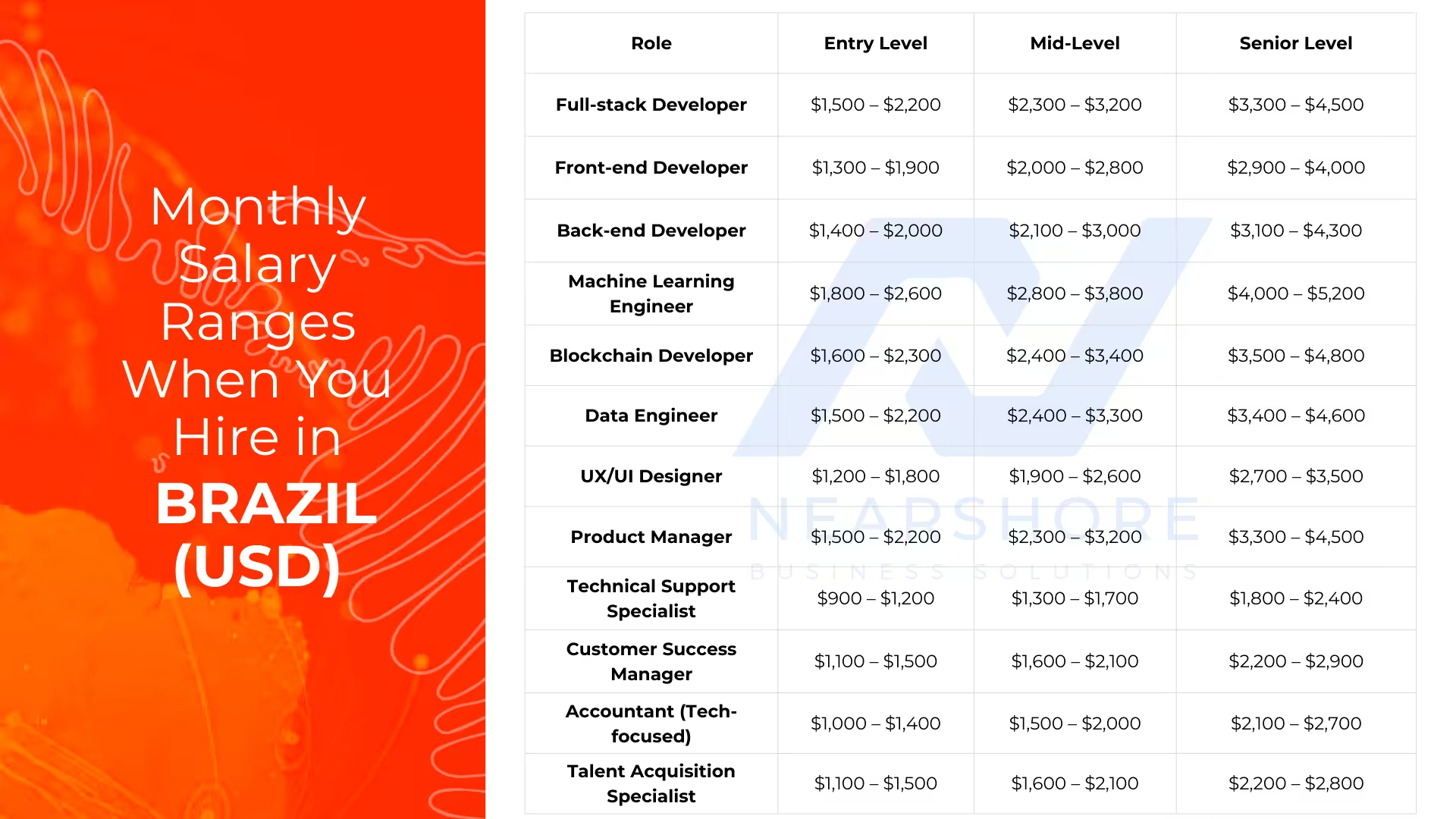

Monthly Salary Ranges When You Hire in Brazil (USD)

Below are average monthly gross salaries in USD for popular roles when you hire in Brazil, categorized by experience level. Rates may vary by region, skill set, and language proficiency.

Employers must make payroll deductions from an employee’s monthly salary when they hire in Brazil, including income tax and social security contributions.

3 Ways to Hire in Brazil

Companies that hire in Brazil can choose from three common models depending on their goals, risk profile, and long-term strategy.

1. Hiring Independent Contractors in Brazil

Independent professionals who manage their own taxes and benefits. Best suited for short-term or project-based work when you hire in Brazil.

PROS

- Quick setup, lower cost, no need for a legal entity

- Flexibility for project-based work

- Minimal administrative burden

CONS

- Risk of misclassification under Brazilian labor law

- Limited control over work arrangements

- No statutory benefits provided

Key Considerations: When hiring independent contractors in Brazil, it’s essential to understand the implications of the employment relationship under Brazilian labor law. Misclassification of workers can lead to significant legal and financial penalties, including fines, back wages, benefits, and back taxes. Companies should ensure that their contractors are genuinely independent, with control over their work schedule and methods.

2. Employer of Record (EOR) to Hire in Brazil

An EOR acts as the legal employer, handling compliance, payroll, and HR, while you manage daily operations when you hire in Brazil.

PROS

- Legally compliant with CLT (Consolidação das Leis do Trabalho)

- Quick hiring without local entity setup

- Full benefits management included

- Reduced administrative complexity

CONS

- Service fees add to employment costs

- Less direct control over employment terms

Key Considerations: Using an EOR when you hire in Brazil is a popular choice for companies that want to hire remote employees without the complexities of setting up a local entity. The EOR model allows businesses to focus on their core operations while leaving the complexities of payroll, tax compliance, and employment contracts to the EOR provider.

3. Local Entity Setup to Hire in Brazil

Establishing a legal company in Brazil allows you to directly hire in Brazil with talent and manage operations internally.

PROS

- Full control over hiring and operations

- Strong brand presence in the market

- Ideal for long-term growth and scaling

- Direct management of employment contracts

CONS

- Complex registration process (4-8 weeks)

- Higher setup and ongoing compliance costs

- Requires understanding of CLT and labor regulations

Key Considerations: Setting up a local entity when you hire in Brazil is a strategic move for businesses aiming for long-term growth and a significant presence in the market. This model provides full control over hiring practices, employment contracts, and employee benefits. However, understanding permanent establishment implications is crucial to avoid unexpected tax obligations.

Employment Compliance and Contracts When You Hire in Brazil

Statutory Benefits When You Hire in Brazil

Entity Setup in Brazil

Establishing a legal entity in Brazil allows companies to hire employees directly and operate long-term.

Legal Structures

| Structure | Description | Best For |

|---|---|---|

| LTDA (Sociedade Limitada) | Most popular; offers limited liability and flexibility | Small to medium enterprises |

| S.A. (Sociedade Anônima) | For larger corporations with complex structures | Large enterprises seeking capital |

| MEI (Micro Entrepreneur) | Simplified tax regime | Individual entrepreneurs, very small businesses |

Registration Steps

- Register with Commercial Registry – Ensure documentation complies with local regulations

- Obtain CNPJ (Tax ID) – From Receita Federal for all financial and legal transactions

- Register with eSocial and FGTS – Comply with employment and tax regulations

- Set Up Tax Books – Digital and physical for accurate financial records

- Open Corporate Bank Account – For payroll and tax payments (Banco do Brasil, Bradesco, Itaú, Santander)

Timeline: Typically 4–8 weeks depending on region and document readiness.

Key Consideration: Understanding permanent establishment is critical. Engaging in activities that generate revenue or having a fixed presence in Brazil can trigger local corporate tax obligations.

Ongoing Compliance in Brazil

Companies operating in Brazil must maintain strict compliance across employment, tax, and regulatory matters.

Annual Tax and Reporting Obligations

| Requirement | Frequency | Details |

|---|---|---|

| SPED/eSocial Declarations | Monthly | Tax and employment reporting |

| IRPJ (Corporate Income Tax) | Annual | Corporate income tax filing |

| CSLL (Social Contribution) | Annual | Social contribution on profits |

| Financial Statements | Annual | Digital bookkeeping to Receita Federal |

Payroll and Social Security

- Monthly payroll must include all deductions and contributions (INSS, FGTS, IRRF)

- eSocial platform is mandatory for payroll reporting

- Employers must generate pay stubs and maintain updated employment records

Risk Mitigation

- Use formal contracts and detailed documentation

- Stay updated on collective bargaining agreements and local employment norms

- Work with local legal and accounting partners to reduce exposure to fines and labor claims

Data Protection Compliance (LGPD)

The Brazilian General Data Protection Law (LGPD) regulates the collection, storage, and use of personal data:

- Data Consent: Obtain explicit consent before collecting employee data

- Adequate Notice: Provide clear information about data processing

- Data Security: Implement measures to protect against breaches

- Penalties: Significant fines for non-compliance

Employers must comply with LGPD when collecting and processing employee data to protect privacy and avoid penalties.

Employee Termination in Brazil

Employee terminations must follow specific procedures under CLT and can involve significant financial obligations.

Grounds and Procedures

| Termination Type | Notice Required | Severance |

|---|---|---|

| With Just Cause | Immediate | None (for serious misconduct) |

| Without Just Cause | 30 days + 3 days/year (max 90 days) | Full package |

| Resignation | 30 days (or pay in lieu) | Limited benefits |

| Mutual Termination | Written agreement | Reduced (20% FGTS penalty) |

Severance Package (Without Just Cause)

- FGTS balance + 40% penalty on FGTS deposits

- Pro-rated 13th salary

- Unused vacation pay + 1/3 vacation bonus

- Any applicable bonuses

- Notice period payment (if not worked)

Mutual Termination

- Allowed under Article 484-A CLT

- Reduces FGTS penalty to 20% and cuts severance by half

- Requires written agreement and mutual consent

Key Consideration: Incorrect termination procedures can result in reinstatement claims or legal penalties. Documentation and legal review are highly recommended for every dismissal.

Conclusion

Brazil stands as Latin America’s premier destination for companies seeking to build remote or in-country teams. With 110 million workers, 100,000 STEM graduates annually, and a mature digital infrastructure boasting 80% internet penetration, Brazil offers unmatched talent depth and quality. The GMT-3 time zone ensures seamless collaboration with North American teams, while cost savings of 50-70% compared to the U.S. make expansion financially strategic.

Brazil’s labor framework under CLT (Consolidação das Leis do Trabalho) is comprehensive and protective, providing clear structure for employment relationships. While more detailed than some neighboring countries, these regulations create stability and predictability that benefit both employers and employees when properly implemented.

Companies can enter the Brazilian market through independent contractors, an Employer of Record (EOR) for rapid deployment, or by establishing a local entity (LTDA) for long-term operations. The right approach depends on your growth stage, hiring volume, and compliance capacity. Key requirements—including eSocial registration, 8% FGTS contributions, INSS payments, 13th-month salary, and 30 days vacation—are manageable with proper guidance and the right partners.

Whether you’re building a development team in São Paulo, establishing customer support in Rio de Janeiro, or hiring specialized professionals across Brazil’s tech hubs, the combination of talent availability, cost efficiency, and cultural alignment makes Brazil an exceptional choice for scaling operations in Latin America.

Frequently Asked Questions When You Hire in Brazil

1. How much does it cost to hire in Brazil?

Hiring costs in Brazil are highly competitive globally. The minimum wage is BRL 1,518/month (approximately $260 USD) as of 2026. Skilled professionals in technology, engineering, and finance typically earn $1,200-$5,000 USD monthly depending on experience and role.

Employers must budget for mandatory costs including:

- INSS contributions (varies by salary bracket)

- FGTS (8% severance fund)

- Risk insurance (1-3%)

- 13th-month salary

- 30 days vacation

- Transportation and meal vouchers

Total employer costs are approximately 26-30% above base salary. Overall, companies save 50-70% compared to North American hiring.

2. What is the best way to hire employees in Brazil?

The best approach depends on your timeline and long-term strategy:

- Employer of Record (EOR): Ideal for rapid market entry without a legal entity. Handles all CLT compliance, payroll, eSocial registration, and benefits within days.

- Independent Contractors: Offers flexibility for project-based or temporary work, though misclassification risks exist.

- Local Entity (LTDA): Best for long-term operations with multiple employees, providing full control.

Most companies start with an EOR to test the Brazilian market before committing to entity formation.

3. Can I hire remote workers in Brazil without a local entity?

Yes. You can hire without establishing a local entity by using an Employer of Record (EOR) or hiring independent contractors.

An EOR acts as the legal employer under CLT, managing all compliance including payroll, eSocial registration, INSS contributions, FGTS deposits (8%), 13th-month salary, 30 days vacation, and mandatory benefits while you direct daily work. This allows you to compliantly hire full-time employees within 3-7 business days.

Contractors manage their own taxes, though proper classification is critical to avoid misclassification penalties and legal liability.

4. What are the key labor laws when hiring in Brazil?

Key labor laws under CLT include:

- Standard workweek: 44 hours

- Paid vacation: 30 days annually

- 13th-month salary: Paid in November and December

- FGTS contributions: 8% of salary

- Mandatory benefits: Transportation and meal vouchers

- Maternity leave: 120 days paid

- Paternity leave: 5 days (extendable to 20 days)

- Severance pay (termination without cause): FGTS balance + 40% penalty, unused vacation, pro-rated 13th salary

- eSocial registration: Mandatory for all employees

- Overtime rates: 150% (weekdays), 200% (Sundays/holidays)

Collective bargaining agreements may add additional requirements.

5. How long does it take to hire employees in Brazil?

Timeline varies by hiring method:

- EOR: 3-7 business days once candidates are selected

- Contractors: 1-3 days after contract agreement

- Local entity setup: 4-8 weeks, including Commercial Registry registration, CNPJ from Receita Federal, eSocial and FGTS registration, tax books setup, and corporate bank account opening. After entity setup, individual hiring proceeds within 1-2 weeks.

6. What is the minimum wage in Brazil?

The minimum wage for 2026 is BRL 1,518 per month (approximately $260 USD), set by the federal government.

However, skilled professionals in high-demand sectors—software development, data engineering, machine learning, digital marketing, and customer support—typically earn significantly above minimum wage, ranging from $1,200-$5,000 USD monthly depending on experience, specialization, and language proficiency. Brazil produces 100,000+ STEM graduates annually. Major tech hubs like São Paulo, Rio de Janeiro, and Curitiba command higher salaries than secondary cities.

7. Do I need to pay taxes when hiring in Brazil?

Yes. Tax obligations under CLT include:

Employer contributions:

- INSS (social security): Varies by salary bracket

- FGTS (severance fund): 8%

- Risk insurance: 1-3%

- Total: Approximately 26-30% of gross salary

Tax withholding:

- Income tax (IRRF): Withheld from employee wages based on progressive rates and remitted to Receita Federal

- Monthly reporting: Through eSocial is mandatory

Entity taxes (if applicable):

- IRPJ (corporate income tax)

- CSLL (social contribution on profits)

An EOR handles all these obligations on your behalf.

8. What are the benefits of hiring in Brazil vs. other Latin American countries?

Brazil offers unique advantages:

- Largest economy and labor force in Latin America: 110+ million workers and 100,000+ STEM graduates annually

- Time zone alignment: GMT-3 provides excellent overlap with U.S. Eastern and Central time

- Mature tech ecosystem: São Paulo, Rio de Janeiro, and other hubs rival any in the region

- Strong government support: SENAI, SEBRAE, and innovation programs foster entrepreneurship

- Cost savings: 50-70% compared to North America

- Digital infrastructure: High internet penetration (82%+)

- Established labor protections: CLT framework

- Cultural alignment: Western business practices

How Can We Help You?

Whether you’re hiring your first role in Brazil or scaling an entire team, we support U.S. companies at every stage of the hiring journey:

- Remote Talent Recruitment – End-to-end recruiting for remote hires in Brazil, including market benchmarking, vetting, and candidate selection.

- In-Country Recruitment – Local, country-specific recruitment for companies building teams directly in Brazil.

- Recruitment as a Service (RaaS) – An embedded recruiting model where our team operates as an extension of yours to support ongoing or multi-role hiring needs.

- Staff Augmentation – Dedicated nearshore talent that integrates directly into your workflows, allowing you to scale teams quickly and predictably.

Ready to get started?

Tell us what roles you’re hiring for, and we’ll help you understand market availability, salary ranges, and the best hiring model for your team.