Mexico has emerged as the premier destination for companies looking to expand their remote teams and access world class talent in Latin America. With a labor force of 61.8 million people, the second largest tech ecosystem in the region valued at $17.3 billion, and cost savings of 40% to 67% compared to U.S. hiring, Mexico offers unmatched opportunities for businesses seeking skilled professionals. This comprehensive guide covers everything you need to know about how to hire in Mexico, from exploring hiring methods and understanding labor laws to setting up a local entity. Whether you are a startup hiring your first Mexican contractor or a growing company establishing a local presence, this resource will help you navigate the Mexican market efficiently and compliantly in 2026.

What Are the Key Statistics About Mexico?

Mexico is one of Latin America’s largest and most dynamic labor markets. Here are the essential facts you need to know before hiring in Mexico.

- Language: Spanish is the official language, though English proficiency varies significantly by sector. While Mexico ranks #103 globally in English proficiency, professionals in IT average scores of 559 and those in Strategy and Project Management average 627, indicating strong bilingual capabilities in business sectors.

- Time Zone: Mexico operates in GMT 6 (Central Standard Time), though this varies by region, providing excellent overlap with U.S. business hours for real time collaboration.

- Population: The country has approximately 132.5 million people, with a median age of 29.6 years, making it the youngest workforce in North America.

- Major Talent Hubs: Mexico City, Guadalajara, Monterrey, and Tijuana are the primary centers for skilled professionals. Mexico City hosts 48% of the country’s startups and 67% of its unicorns.

- Internet Penetration: Over 70% of the population has internet access, with extensive high speed connectivity in urban areas where 87.86% of the population resides.

- Labor Force: The Economically Active Population reached 61.8 million workers in mid 2025, with a labor force participation rate of approximately 59.91% and a historically low unemployment rate between 2.6% and 3.0%.

- Education: Mexico has a 95% literacy rate with approximately 130,000 STEM graduates entering the workforce annually. In 2023 to 2024, 5.2 million students were enrolled in higher education across more than 3,100 institutions.

Why Should You Hire in Mexico in 2026?

Mexico offers a unique combination of cost effective labor, a massive skilled workforce, economic stability, geographic proximity to the United States, and a thriving tech ecosystem that makes it one of the best hiring destinations in Latin America.

Is Hiring in Mexico Cost Effective?

Hiring in Mexico provides significant cost savings of 40% to 67% compared to the United States. Salaries for software developers, engineers, and other tech professionals are substantially lower while maintaining high quality output. The total cost of employment, including all mandatory contributions, runs between 36% and 50% above base salary, which remains highly competitive compared to U.S. hiring costs.

Does Mexico Have a Skilled Workforce?

Mexico boasts one of the largest and most educated workforces in Latin America. With 61.8 million workers and over 130,000 STEM graduates entering the workforce annually, companies have access to an estimated 563,000 to 700,000 software developers. Mexico’s technical talent pipeline is anchored by world class institutions including Tecnológico de Monterrey (ITESM), consistently ranked among the top universities in Latin America for engineering and business and ranked 5th globally for undergraduate entrepreneurship. Universidad Nacional Autónoma de México (UNAM) is the largest university in Latin America and the national leader in graduate output, with over 350,000 students. Other leading institutions include Instituto Politécnico Nacional (IPN), a cornerstone of technical and manufacturing education, and Universidad de Guadalajara, which produces large scale tech specialists in Jalisco. Women now account for 53% of bachelor’s degree graduates and have surpassed men in master’s degree completions for the first time.

Is the Mexican Economy Stable?

Mexico has one of the most stable economies in Latin America, with GDP growth projected between 1.0% and 1.5% for 2026. Foreign Direct Investment reached $36.9 billion in 2024 and continues to track strongly. Inflation is projected to decline to approximately 3.4% by the end of 2025, providing a more stable environment for wage planning. The IT services market alone is valued at $21.28 billion in 2025 and projected to reach $37.28 billion by 2030.

What Government Support Is Available for Foreign Companies?

Mexico’s position under the USMCA (United States Mexico Canada Agreement) provides unique advantages for U.S. companies. The agreement includes provisions for digital trade, cross border data flows, and intellectual property protection, making Mexico an ideal nearshore destination with strong legal frameworks aligned to U.S. business practices.

The IMMEX (Maquiladora) program offers duty free temporary imports of raw materials and equipment for export oriented operations, which has been instrumental in attracting over $30 billion in annual foreign direct investment. For tech companies, this can translate to reduced operational costs for hardware, equipment, and infrastructure.

The government has also implemented the Nearshoring Decree (Plan Mexico), which allows accelerated depreciation of 41% to 91% of new fixed assets and a 25% additional tax deduction for workforce training expenses in technical and digital skills. Key target sectors include semiconductors, automotive and electromobility, medical devices, and electrical equipment.

Additional initiatives include PROSOFT (software industry development program), which provides grants and tax incentives for technology companies, and the National Digital Strategy aimed at positioning Mexico as a global digital hub.

How Does Geographic Proximity Benefit Collaboration?

Mexico’s close geographic proximity to the United States makes it an ideal location for nearshoring, with 49% of U.S. companies now nearshoring IT and software development to Mexico or Canada. The country shares time zones with much of the U.S., facilitating real time collaboration including daily standups and synchronous communication. Nearshoring is expected to create 2 to 4 million new jobs in Mexico by 2030.

How Strong Is Mexico’s Tech Ecosystem?

Mexico is the second largest tech ecosystem in Latin America after Brazil, valued at approximately $17.3 billion and projected to grow at a 10.6% annual rate through 2030. The country hosts 1,083 active tech startups, with notable unicorns including Kavak, Clip, Bitso, and Clara. Approximately 60% to 61% of all venture capital investment in Mexico goes to Fintech, driven by the massive unbanked population and regulatory support via the Fintech Law.

Guadalajara has earned its reputation as Mexico’s Silicon Valley, anchored by the Guadalajara Creative Digital City (Ciudad Creativa Digital) initiative. This government backed technology district hosts major tech companies including Intel, IBM, Oracle, HP, and Bosch, alongside a thriving startup ecosystem. The tech sector in Guadalajara generates $21 billion annually, employs over 125,000 professionals, and recorded a 16.8% annual growth rate in its startup ecosystem in 2025.

What Types of Talent Can You Hire in Mexico?

Mexico offers a highly educated and diverse talent pool across technology, design, customer support, sales, marketing, finance, engineering, and many other industries. The following salary ranges reflect annual compensation in USD based on 2025 to 2026 market data. Salaries in high growth sectors have increased 15% to 25% over the past two years, driven by competition from U.S. remote work options.

What Tech Talent Is Available in Mexico?

Mexico’s tech sector employs an estimated 563,000 to 700,000 software developers, with the most in demand skills including AI and Machine Learning (96% of companies report integrating AI into their strategies), cybersecurity (with a shortage of 260,000 skilled workers nationally), and cloud infrastructure (expected to reach 58% adoption by 2026). Generative AI course enrollments surged 356% in 2025. The TecNM (National Technological Institute of Mexico) recently launched seven new degree programs focused on semiconductors, artificial intelligence, and data science to address workforce shortages in these high growth areas.

- Software Developer (Junior): $24,000 to $36,000 per year. Entry level developers with foundational knowledge in programming languages such as JavaScript, Python, or Java.

- Software Developer (Mid Level): $40,000 to $55,000 per year. Developers with 3 to 5 years of experience capable of working independently on complex features and contributing to architectural decisions.

- Software Developer (Senior): $55,000 to $75,000 per year. Experienced developers who can lead projects, mentor junior team members, and make critical technical decisions. Senior and Lead roles typically command a 30% to 50% premium over mid level figures.

- Full Stack Developer: $45,000 to $62,000 per year. Versatile developers proficient in both frontend and backend technologies, capable of building complete web applications.

- Mobile App Developer: $40,000 to $56,000 per year. Specialists in iOS, Android, or cross platform development using frameworks like React Native or Flutter.

- DevOps Engineer: $48,000 to $72,000 per year. Professionals skilled in cloud infrastructure, CI/CD pipelines, and automation tools such as AWS, Docker, and Kubernetes.

- QA Automation Engineer: $35,000 to $50,000 per year. Quality assurance specialists responsible for automated testing to ensure software reliability.

- Data Scientist: $55,000 to $85,000 per year. Advanced analysts with expertise in machine learning, statistical modeling, and programming languages like Python and R. High demand in Fintech and Retail sectors.

- Cybersecurity Engineer: $50,000 to $75,000 per year. Security professionals who protect systems and data from threats, conduct vulnerability assessments, and implement security protocols.

- AI and Machine Learning Engineer: $82,200 to $102,300 per year for senior positions. Specialists in artificial intelligence and machine learning applications.

What Creative Professionals Can You Hire in Mexico?

Mexico has a vibrant creative community with professionals skilled in digital design, branding, and multimedia production.

- Graphic Designer: $18,000 to $30,000 per year. Designers who create visual content for marketing materials, social media, and brand assets using tools like Adobe Creative Suite.

- UI/UX Designer: $30,000 to $48,000 per year. Specialists focused on user interface design and user experience research to create intuitive digital products.

- Video Editor: $18,000 to $36,000 per year. Professionals skilled in editing footage, adding effects, and producing polished video content for marketing or entertainment purposes.

- Motion Graphics Designer: $24,000 to $42,000 per year. Creatives who combine graphic design with animation to produce engaging visual content for videos and advertisements.

- Content Creator: $15,000 to $28,000 per year. Versatile professionals who produce written, visual, or video content for social media platforms and digital marketing campaigns.

What Customer Service Talent Is Available in Mexico?

Mexico has established itself as a premier nearshore destination for customer service operations, with strong concentrations of bilingual professionals particularly in Tijuana for technical and customer support roles.

- Bilingual Customer Service Representative: $12,000 to $18,000 per year. Frontline support staff who handle customer inquiries via phone, email, or chat. Salaries vary by shift and technical complexity.

- Technical Support Specialist: $15,000 to $24,000 per year. Support professionals with technical knowledge who assist customers with product related issues and troubleshooting.

- Customer Success Manager: $24,000 to $42,000 per year. Relationship focused professionals who ensure customer satisfaction, drive retention, and identify upselling opportunities.

- Call Center Team Lead: $18,000 to $30,000 per year. Supervisors who manage customer service teams, monitor performance metrics, and ensure quality standards are met.

What Sales and Marketing Professionals Can You Find in Mexico?

Businesses can access talented sales and marketing professionals to support growth initiatives and market expansion throughout Latin America and beyond.

- Sales Development Representative: $18,000 to $28,000 per year (plus commission). Entry level sales professionals responsible for lead generation, prospecting, and qualifying potential customers. Requires high English fluency.

- Account Executive: $24,000 to $42,000 per year (plus commission). Sales professionals who manage the full sales cycle from initial contact to closing deals.

- Digital Marketing Specialist: $18,000 to $32,000 per year. Marketers skilled in SEO, SEM, social media marketing, and online advertising campaigns.

- Marketing Manager: $36,000 to $55,000 per year. Strategic leaders who develop and execute marketing plans, manage budgets, and oversee marketing teams.

- Social Media Manager: $15,000 to $28,000 per year. Specialists who create content, manage social media accounts, and engage with online communities to build brand presence.

- SEO Specialist: $18,000 to $32,000 per year. Professionals focused on improving website visibility and organic search rankings through technical and content optimization.

- Copywriter: $15,000 to $28,000 per year. Writers who craft compelling marketing copy, blog posts, email campaigns, and advertising content.

What Finance Professionals Are Available in Mexico?

Mexico produces qualified finance professionals who can support accounting, bookkeeping, and financial analysis functions for international companies.

- Bookkeeper: $12,000 to $20,000 per year. Professionals who maintain financial records, process transactions, and reconcile accounts.

- Accountant: $18,000 to $32,000 per year. Certified professionals who prepare financial statements, manage tax compliance, and oversee accounting operations.

- Financial Analyst: $28,000 to $45,000 per year. Analysts who evaluate financial data, create forecasts, and provide recommendations to support business decisions.

- Finance/Accounting Manager: $30,000 to $55,000 per year. Senior finance professionals who oversee accounting departments, ensure regulatory compliance, and manage financial reporting. Requires US GAAP or IFRS knowledge.

What Administrative Talent Can You Hire in Mexico?

Administrative professionals in Mexico provide essential support for day to day business operations at competitive rates.

- Virtual Assistant: $12,000 to $20,000 per year. Remote professionals who handle administrative tasks such as scheduling, email management, travel arrangements, and research.

- Executive Assistant: $18,000 to $32,000 per year. Senior administrative professionals who support executives with complex scheduling, communication, and project coordination.

- Project Manager: $32,000 to $55,000 per year. Professionals who plan, execute, and oversee projects to ensure they are completed on time and within budget.

- Operations Manager: $38,000 to $65,000 per year. Leaders who optimize business processes, manage teams, and ensure operational efficiency.

- Human Resources Specialist: $18,000 to $30,000 per year. HR professionals who handle recruitment, onboarding, employee relations, and compliance with labor regulations.

- Recruiter: $15,000 to $28,000 per year. Talent acquisition specialists who source, screen, and hire candidates for open positions.

What Engineers Can You Hire in Mexico?

Mexico’s universities produce engineers and technical professionals across various disciplines, particularly in manufacturing and industrial sectors central to the automotive and aerospace industries.

- Civil Engineer: $24,000 to $42,000 per year. Licensed engineers who design, plan, and oversee construction and infrastructure projects.

- Mechanical Engineer: $24,000 to $42,000 per year. Engineers who design and develop mechanical systems and products.

- Electrical Engineer: $24,000 to $45,000 per year. Professionals who design and maintain electrical systems and equipment.

- Industrial Engineer: $20,000 to $38,000 per year. Engineers focused on optimizing processes, improving efficiency, and reducing waste in manufacturing and operations.

- Manufacturing Engineer: $24,000 to $42,000 per year. Specialists who design and improve manufacturing processes in Mexico’s robust manufacturing sector.

What Should You Consider When Planning Salaries in Mexico?

Salaries in Mexico City tend to be higher than in secondary cities, though the Mexico City ecosystem is cited as being 347% stronger than Monterrey’s. Bilingual professionals who speak both Spanish and English typically command a premium of 20% to 35% above standard rates. Specialized skills in high demand areas such as AI, cybersecurity, or cloud computing may require salaries at the higher end of the ranges. Over the past three years, salaries in high growth sectors have increased at double the rate of national inflation. Approximately 70% of Mexican employers report difficulty finding talent with specific digital and technical skills, and in advanced manufacturing the probability of facing performance issues due to talent gaps is 160% higher than in other sectors. Nearly 50% of young professionals are estimated to lack the soft skills or specific technical applications required for roles generated by the nearshoring boom.

What Is the Total Cost of Hiring an Employee in Mexico?

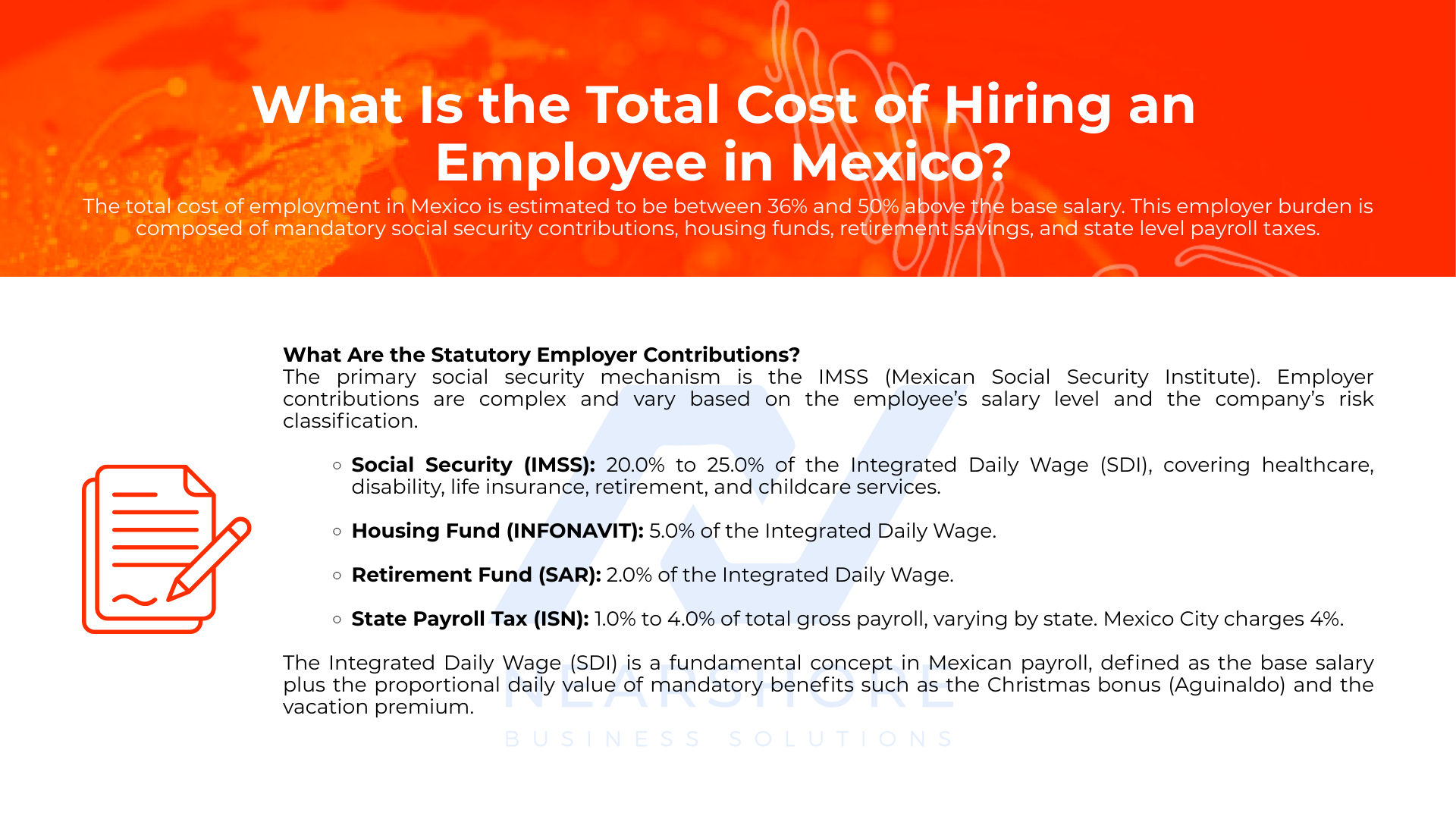

The total cost of employment in Mexico is estimated to be between 36% and 50% above the base salary. This employer burden is composed of mandatory social security contributions, housing funds, retirement savings, and state level payroll taxes.

What Are the Statutory Employer Contributions?

The primary social security mechanism is the IMSS (Mexican Social Security Institute). Employer contributions are complex and vary based on the employee’s salary level and the company’s risk classification.

Social Security (IMSS): 20.0% to 25.0% of the Integrated Daily Wage (SDI), covering healthcare, disability, life insurance, retirement, and childcare services.

Housing Fund (INFONAVIT): 5.0% of the Integrated Daily Wage.

Retirement Fund (SAR): 2.0% of the Integrated Daily Wage.

State Payroll Tax (ISN): 1.0% to 4.0% of total gross payroll, varying by state. Mexico City charges 4%.

The Integrated Daily Wage (SDI) is a fundamental concept in Mexican payroll, defined as the base salary plus the proportional daily value of mandatory benefits such as the Christmas bonus (Aguinaldo) and the vacation premium.

What Mandatory Benefits Must Employers Provide?

The Federal Labor Law (Ley Federal del Trabajo) mandates several benefits that must be accounted for in any hiring budget.

Aguinaldo (Christmas Bonus): A minimum of 15 days’ salary, payable by December 20th each year. Many employers offer more than the minimum to remain competitive.

Vacation Days: Following the Vacaciones Dignas reform effective 2023, workers are entitled to 12 days after one year of service, increasing with tenure. This was doubled from the previous 6 days.

Vacation Premium: A 25% surcharge on the salary paid during vacation days.

Profit Sharing (PTU): Companies must distribute 10% of their taxable annual profits among employees, capped at three months’ salary or the average of the last three years’ PTU, whichever is lower. This is typically paid by May 30th each year.

What Additional Benefits Are Common in Competitive Roles?

Standard Federal Labor Law benefits are no longer sufficient to attract top tech or business talent. Employers must offer superior benefits to compete with both local unicorns and U.S. remote work options. Common additions include food vouchers (vales de despensa) usually at 10% of salary, savings funds, and private health insurance, which is highly valued due to limitations of the public IMSS healthcare system.

Major Talent Hubs in Mexico

Mexico City: Multi-Sector Powerhouse

Mexico City dominates the tech and business ecosystem, hosting 48% of the country’s startups and 67% of its unicorns. Home to 526 startups with strong concentration in Fintech and E-commerce, the city’s ecosystem is 347% stronger than Monterrey’s. UNAM and IPN, Mexico’s two largest universities, provide a steady talent pipeline. Monthly cost of living ranges from $1,200 to $1,500, with city center rent between $500 and $800.

Guadalajara: Mexico’s Silicon Valley

Jalisco’s capital has evolved from electronics manufacturing to advanced software and R&D. The city hosts 105 startups (10% of national total) and major R&D centers for Intel, HP, IBM, and Bosch. The tech sector generates $21 billion annually and employs over 125,000 professionals, with the startup ecosystem growing 16.8% in 2025. ITESO and Universidad de Guadalajara fuel the local talent pipeline. Monthly costs range from $1,000 to $1,300, with rent between $400 and $650.

Monterrey: Advanced Manufacturing Hub

Located in Nuevo León, Monterrey is the primary hub for advanced manufacturing and logistics, particularly in automotive and aerospace. The city ranks second nationally for startups and is a growing fintech center. Home to Tecnológico de Monterrey and industrial giants like FEMSA and Grupo Bimbo, it’s also part of Tesla’s expanding supply chain. Monthly costs range from $1,100 to $1,400, with rent between $450 and $700.

Tijuana: Strategic Border Location

Tijuana serves as a nearshore extension for Southern California’s tech corridor. It leads in medical device manufacturing and cross-border logistics, with the highest concentration of bilingual professionals in technical and customer support roles.

Querétaro: Emerging Aerospace Center

Querétaro has become a center for aerospace engineering and advanced manufacturing, attracting significant foreign investment. Monthly costs range from $900 to $1,200, with rent between $350 and $550.

Three Ways to Hire in Mexico

1. Hire Contractors

Contractors operate as self-employed individuals, managing their own taxes and benefits. This is the quickest option for short-term or project-based work.

Advantages: Flexible for variable workloads, cost-effective with no benefits required, simple setup with minimal paperwork.

Disadvantages: Compliance risks from potential misclassification, limited control over workers, difficulty attracting top talent.

Key consideration: Draft detailed contracts defining scope, payment, and confidentiality. Following 2021 reforms, strictly distinguish between contractors and employees to avoid penalties.

2. Use an Employer of Record (EOR)

An EOR becomes the legal employer of your Mexican staff, handling payroll, taxes, benefits, and compliance without requiring you to establish a local entity.

Advantages: Ensures compliance with local laws, enables quick onboarding, reduces administrative burden.

Disadvantages: Monthly fees per employee, less direct control over employment decisions.

Key consideration: Ideal for testing the Mexican market or hiring a small team without local incorporation.

3. Establish a Legal Entity

Setting up a local entity gives you full control over hiring and operations. Best for businesses planning a long-term presence and scaling operations.

Advantages: Direct control over hiring and employment terms, stronger local brand presence, optimal for long-term growth.

Disadvantages: Takes four to eight weeks to establish, higher upfront and ongoing costs, complex regulatory requirements.

Key consideration: Requires registering with SAT (tax ID), IMSS (employee benefits), and INFONAVIT (housing fund), plus ongoing compliance with tax and labor laws.

Guide to Labor Laws and Compliance for Hiring in Mexico

Mexican labor laws are governed by the Federal Labor Law (Ley Federal del Trabajo), which establishes comprehensive protections for employees. Understanding these regulations is essential for any business looking to hire in Mexico.

Employment Contracts

All employment contracts in Mexico must be in writing and include job description, salary, benefits, working hours, and termination conditions. Mexican labor law recognizes several contract types:

Indefinite Term Contracts are the default in Mexico, offering employees job security with no set end date unless specified otherwise.

Fixed Term Contracts are suitable for temporary roles or projects with defined duration. These must clearly specify the reason for the fixed term and the expected end date.

Seasonal Contracts are designed for roles required only during specific periods, such as harvest seasons or holiday retail operations.

Trial Period Contracts allow employers to evaluate new hires for up to 30 days (or 180 days for management positions) before confirming permanent employment.

Working Hours and Overtime

The standard workweek in Mexico is 48 hours, typically spread over six days. Day shifts are limited to 8 hours, mixed shifts to 7.5 hours, and night shifts to 7 hours. When employees work overtime, they must be paid double their regular hourly rate for the first 9 hours per week, and triple thereafter. It’s worth noting that a potential reduction of the statutory workweek from 48 to 40 hours is currently under debate in the Mexican Congress.

Vacation and Leave Entitlements

Following the Vacaciones Dignas reform that took effect in January 2023, employees now receive 12 days of paid vacation after completing one year of service—doubled from the previous 6 days. This increases by 2 days for each subsequent year through year five, then by 2 days every 5 years thereafter. Employees also receive a vacation premium of at least 25% of their salary during vacation days.

For parental leave, female employees are entitled to 12 weeks of paid maternity leave (6 weeks before delivery and 6 after), paid through social security. Male employees receive 5 days of paid paternity leave following the birth of their child.

Mandatory Bonuses and Profit Sharing

Aguinaldo (Christmas Bonus) is a mandatory payment equal to at least 15 days of salary that must be paid before December 20 each year. Employees who have worked less than a full year receive a proportional amount based on their time with the company.

Profit Sharing (PTU) requires companies to distribute 10% of their pre-tax profits to employees annually by May 30. The distribution is calculated based on the number of days worked and salary earned by each employee during the fiscal year, capped at three months’ salary or the average of the last three years’ PTU, whichever is lower.

Minimum Wage and Compensation

Effective January 1, 2026, the general minimum wage in Mexico increased to $315.04 MXN per day (a 13% increase), while the Northern Border Free Zone rate rose to $440.87 MXN per day. This aggressive minimum wage policy reflects the government’s commitment to real wage recovery and establishes the baseline for all compensation structures.

Public Holidays

Employees are entitled to paid time off for official public holidays. Those who work on mandatory rest days earn triple pay for that day. Mexico observes eight official holidays: New Year’s Day (January 1), Constitution Day (first Monday of February), Benito Juárez’s Birthday (third Monday of March), Labor Day (May 1), Independence Day (September 16), Revolution Day (third Monday of November), Presidential Inauguration Day (December 1, every six years), and Christmas Day (December 25).

Severance Pay and Termination

When employees are terminated without just cause, they are entitled to comprehensive severance pay including three months’ salary (indemnización constitucional), 20 days’ salary for each year worked (prima de antigüedad), plus any accrued vacation, vacation premium, and proportional Aguinaldo.

Tax Obligations

Mexico’s corporate income tax rate is 30% of taxable profits, while Value Added Tax (IVA) is 16% on most goods and services (some items like food and medicine may be exempt or subject to 0% rate).

Employers must withhold income tax (ISR) from employee salaries at progressive rates ranging from 1.92% to 35%, depending on income levels. They are also responsible for remitting social security, housing fund, and retirement contributions on behalf of employees.

Subcontracting and Outsourcing Regulations

Following the 2021 reforms, outsourcing of core business activities is prohibited in Mexico. Companies can only subcontract specialized services that are not part of their main economic purpose. All specialized service providers must register with the Ministry of Labor (REPSE), and clients are jointly liable for the social security and tax obligations of the provider’s employees. The cost of non-compliance, including fines and joint liability, often exceeds any savings from informal arrangements.

Data Protection Requirements

Mexico has strict data protection regulations under the Federal Law on Protection of Personal Data Held by Private Parties (LFPDPPP). Employers must obtain consent before collecting personal data, provide privacy notices explaining how data will be used, implement security measures to protect against unauthorized access, and allow employees to access, correct, or delete their personal information.

Remote Work Framework

Remote work in Mexico is governed by the Teletrabajo Law, which applies when more than 40% of an employee’s work is performed off-site. In these cases, employers must provide necessary tech equipment, pay portions of electricity and internet costs, and respect the employee’s right to disconnect outside working hours. This framework reflects the current reality where nearly 60% of tech professionals operate in hybrid or fully remote settings, and 58% of talent acquisition specialists have moved to virtual-first recruitment.

Setting Up a Legal Entity

For businesses planning a long-term presence in Mexico, establishing a local legal entity provides full control over hiring and operations. The process typically takes four to eight weeks.

Entity Types: The most common structures are Sociedad Anónima (S.A.), a corporation suitable for larger businesses requiring at least two shareholders and a board of directors; Sociedad de Responsabilidad Limitada (S. de R.L.), a limited liability company ideal for smaller businesses with simpler governance; and Sociedad Anónima Promotora de Inversión (S.A.P.I.), a flexible structure designed for startups seeking investment.

Registration Process: Companies must obtain name authorization from the Ministry of Economy, draft and notarize bylaws before a Mexican notary public, register with the Public Registry of Commerce, obtain a Tax Identification Number (RFC) from SAT, register with IMSS for employee benefits, register with INFONAVIT for housing fund contributions, and open a corporate bank account.

Mexico’s Competitive Position

When compared to other Latin American markets, Mexico offers strong value for global organizations. Monthly costs per developer average $4,500 to $7,000, with excellent timezone overlap with the U.S. and high English proficiency in tech sectors. Colombia offers lower costs at $3,500 to $5,500 with similarly strong timezone overlap, while Brazil ($4,000-$6,500) and Argentina ($5,000-$7,500) provide alternatives with varying proficiency and timezone considerations.

Compared to offshore markets like India and the Philippines, Mexico provides 40-60% savings versus U.S. costs (versus 60-80% offshore), real-time collaboration instead of asynchronous communication across 10-12 hour time differences, high cultural fit due to shared history and business practices with the U.S., and specialized talent depth particularly in Fintech and automotive sectors.

Frequently Asked Questions: Hire in Mexico

Can you hire employees in Mexico without setting up a local entity?

Yes, through an Employer of Record (EOR) service. The EOR becomes the legal employer and manages payroll, taxes, benefits, and compliance, allowing you to hire Mexican talent quickly while staying compliant with local labor laws.

What’s the difference between an EOR and a PEO in Mexico?

An Employer of Record (EOR) is the full legal employer, handling all payroll, taxes, and compliance. A Professional Employer Organization (PEO) acts as a co-employer, sharing responsibilities with your company. EORs work best for companies without a local entity; PEOs typically require an existing legal presence.

How long does it take to set up a company in Mexico?

Four to eight weeks, depending on entity type and complexity. This includes name authorization, notarizing bylaws, registering with SAT, IMSS, and INFONAVIT, and opening a corporate bank account.

What is the minimum wage in Mexico in 2026?

As of January 1, 2026, the general minimum wage is $315.04 MXN per day (13% increase). In the Northern Border Free Zone, it’s $440.87 MXN per day.

How many vacation days are employees entitled to?

Under the Vacaciones Dignas reform (effective January 2023), employees receive 12 days of paid vacation after one year of service. This increases by 2 days annually through year five, then 2 days every 5 years thereafter. Employees also receive a 25% vacation premium.

What is the Aguinaldo?

A mandatory Christmas bonus equal to at least 15 days of salary, paid before December 20 annually. Employees who worked less than a full year receive a proportional amount.

What is Profit Sharing (PTU)?

Companies must distribute 10% of pre-tax profits to employees annually by May 30. Distribution is based on days worked and salary earned, capped at three months’ salary or the average of the last three years’ PTU, whichever is lower.

What are mandatory employer contributions in Mexico?

Employers must contribute 20-25% of the Integrated Daily Wage to IMSS (social security), 5% to INFONAVIT (housing), 2% to SAR (retirement), and 1-4% of gross payroll for state payroll tax depending on location. Total employment costs typically run 36-50% above base salary.

What are the risks of misclassifying workers as contractors in Mexico?

Following 2021 subcontracting reforms, all specialized service providers must register with REPSE. Misclassification can result in liability for back payment of benefits, social security contributions, profit sharing, severance pay, and substantial fines. Clients are jointly liable for provider employees’ social security and tax obligations.

What is the Teletrabajo Law?

This law regulates remote work in Mexico. When more than 40% of work is done off-site, employers must provide tech equipment, cover a portion of electricity and internet costs, and respect employees’ right to disconnect outside working hours. Nearly 60% of tech professionals now work in hybrid or fully remote settings.

What is the labor informality rate and why does it matter?

The informal employment rate is 54-55%. Informal workers lack social security (IMSS) access and legal protections. For formal employers, the challenge isn’t finding workers—it’s finding formalized talent with technical certifications and corporate experience.

What skills are most in demand in Mexico’s tech sector?

AI and Machine Learning (96% of companies integrating AI), cybersecurity (260,000-worker shortage), and cloud infrastructure (58% adoption expected by 2026). Generative AI course enrollments surged 356% in 2025.

How much do bilingual professionals earn?

Spanish-English bilingual professionals command a 20-35% premium above standard rates. While Mexico ranks #103 globally in English proficiency, IT professionals average 559 on the EF English Proficiency Index.

What is the IMMEX program?

The Maquiladora program offers duty-free temporary imports of raw materials and equipment for export operations. Tech companies can reduce operational costs for hardware, equipment, and infrastructure. The program attracts over $30 billion in annual foreign direct investment.

What government incentives are available for companies hiring in Mexico?

The Nearshoring Decree (Plan Mexico) offers 41-91% accelerated depreciation on new fixed assets and 25% additional tax deduction for workforce training. The PROSOFT program provides grants and tax incentives for technology companies. Northern Border municipalities offer reduced Income Tax and VAT rates for qualifying operations.

Conclusion

Mexico has positioned itself as the premier destination for companies seeking to hire skilled remote talent in Latin America. With its massive workforce of 61.8 million, cost savings of 40% to 67% versus U.S. hiring, world class universities like Tecnológico de Monterrey and UNAM, and a tech ecosystem valued at $17.3 billion, Mexico offers unmatched opportunities for businesses looking to expand. The nearshoring boom is expected to create 2 to 4 million new jobs by 2030, though the window of easy hiring is closing as global competition for Mexico’s best engineers and professionals reaches an all time high.

To succeed in this market, organizations must adopt a compliance first approach ensuring rigorous adherence to REPSE subcontracting rules and the Teletrabajo laws. Standard Federal Labor Law benefits are no longer sufficient to attract top talent, so employers must offer competitive benefits including private medical insurance and food vouchers. Finally, companies should match their hiring strategy to specific regional hubs, focusing on Guadalajara for electronics engineering, Mexico City for Fintech and large scale BPO, and Monterrey for manufacturing and automotive sectors.

Whether you are testing the waters with contractors, using an EOR for compliance, or setting up a legal entity for long term growth, strategic investment in competitive compensation, training, and local ecosystem integration will be the hallmarks of successful hiring in Mexico for the remainder of the decade.

How Can We Help You?

Whether you’re hiring your first role in Colombia or scaling an entire team, we support U.S. companies at every stage of the hiring journey:

- Remote Talent Recruitment – End-to-end recruiting for remote hires in Colombia, including market benchmarking, vetting, and candidate selection.

- In-Country Recruitment – Local, country-specific recruitment for companies building teams directly in Colombia.

- Recruitment as a Service (RaaS) – An embedded recruiting model where our team operates as an extension of yours to support ongoing or multi-role hiring needs.

- Staff Augmentation – Dedicated nearshore talent that integrates directly into your workflows, allowing you to scale teams quickly and predictably.

Ready to get started?

Tell us what roles you’re hiring for, and we’ll help you understand market availability, salary ranges, and the best hiring model for your team.