Colombia is quickly becoming a go-to destination for companies looking to hire in Colombia and build skilled, cost-effective remote teams in Latin America. With a strong supply of bilingual professionals, competitive salaries, and alignment with U.S. time zones, it’s no surprise that global employers are turning to hire in Colombia for their staffing needs.

In this guide, we break down everything you need to know to hire in Colombia, from salary ranges and hiring models to labor laws, compliance, and employer responsibilities. Whether you’re hiring your remote team or planning to set up a local entity to hire in-country, this guide will help you navigate the process step by step when you hire in Colombia.

Why Hire in Colombia?

When you hire in Colombia, you gain access to a powerful combination of talent, affordability, and strategic location—making it one of the most attractive hiring markets in Latin America.

Here are some of the top reasons global employers choose to hire in Colombia:

Skilled Talent Pool

Colombia produces over 120,000 university graduates annually, with a growing number focused on STEM, finance, business, and digital careers. This makes it easier to hire in Colombia for specialized roles across multiple industries.

Cost-Effective Salaries

Monthly salaries are significantly lower than in the U.S. or Europe, allowing companies that hire in Colombia to reduce costs while maintaining quality—often saving 40-70% on employment costs.

Time Zone Alignment

GMT-5 year-round. Aligns with US Eastern Time in winter, and shifts to align with US Central Time in summer (since Colombia does not observe daylight saving time).

Remote Work Readiness

With strong internet infrastructure (over 70% penetration) and widespread digital adoption, professionals you hire in Colombia are well-equipped for remote roles.

Cultural Compatibility

Colombian professionals are known for their strong work ethic, professionalism, and communication skills—closely aligned with North American business norms. Relationship building is fundamental in Colombian business culture, making it easier to integrate teams when you hire in Colombia.

Government Support

Initiatives like Free Trade Zones and digital infrastructure programs make it easier for foreign companies to hire in Colombia and grow their operations.

Whether you need engineers, marketers, analysts, or support agents, when you hire in Colombia you gain access to the right mix of talent and infrastructure to scale your team quickly.

Key Stats About Hiring in Colombia

Understanding Colombia’s labor force and digital infrastructure can help you evaluate its potential as a remote hiring destination when you hire in Colombia:

Official Language: Spanish (English proficiency is growing, especially in tech and business)

Time Zone: GMT-5 (same as U.S. Eastern Time, no Daylight Saving Time)

Currency: Colombian Peso (COP)

Population: ~51 million (2026 estimate)

Internet Penetration: Over 70%, with widespread high-speed access in major urban areas

Labor Force: ~25 million, with strengths in tech, finance, and customer service sectors

STEM Graduates: ~45,000 per year from top universities across the country

Top Talent Hubs: Bogotá, Medellín, Cali, Barranquilla

Literacy Rate: 95%, with rising investment in technical and bilingual education

Remote Work Readiness: High. Strong digital adoption and real-time collaboration with U.S. teams

National Minimum Wage: For 2026, the minimum wage is set at COP 1,423,500 per month (approximately $380 USD), with additional employer obligations such as transportation allowances and mandatory contributions

Colombia offers the digital infrastructure, bilingual talent, and affordability needed to build strong remote teams when you hire in Colombia across nearly every business function.

What Are the Most In-Demand Roles to Hire in Colombia?

Colombia has rapidly emerged as one of Latin America’s premier talent hubs, attracting global companies seeking skilled professionals across multiple industries. With a young, highly educated workforce and strong English proficiency rates, the country offers an ideal combination of technical expertise, cultural compatibility, and cost-effectiveness for businesses looking to hire in Colombia.

The Colombian workforce is characterized by its adaptability, strong work ethic, and growing specialization in high-demand fields. Major cities like Bogotá, Medellín, and Cali have developed thriving tech ecosystems, while coastal cities such as Barranquilla and Cartagena have become centers for customer service and business process outsourcing. This geographic diversity means companies can hire in Colombia and access specialized talent pools across different regions, each with its own strengths and industry focus.

Key Job Categories and In-Demand Roles

Colombia’s labor market offers an extensive range of skilled professionals across sectors that are critical to modern business operations. Here’s a comprehensive look at the most sought-after roles when you hire in Colombia:

1. Software Development and Engineering

Colombia’s tech sector has experienced exponential growth, producing a steady stream of software engineers and developers who are well-versed in modern technologies and methodologies. The country’s universities and coding bootcamps graduate thousands of tech professionals annually, many with hands-on experience in agile development, cloud technologies, and emerging frameworks.

Frontend Developers

- React, Angular, and Vue.js specialists

- UI/UX-focused developers with design system experience

- Progressive Web App (PWA) developers

- Accessibility and performance optimization experts

Backend Developers

- Node.js, Python (Django/Flask), and Java (Spring Boot) developers

- Microservices architecture specialists

- API design and development experts

- Database administrators (PostgreSQL, MongoDB, MySQL)

Full-Stack Developers

- MERN/MEAN stack developers

- Ruby on Rails developers

- PHP/Laravel developers

- Serverless architecture specialists

Mobile App Developers

- Native iOS developers (Swift, SwiftUI)

- Native Android developers (Kotlin, Java)

- Cross-platform developers (React Native, Flutter)

- Mobile UI/UX specialists

DevOps and Infrastructure Engineers

- Cloud platform specialists (AWS, Azure, Google Cloud)

- CI/CD pipeline engineers

- Kubernetes and Docker experts

- Site Reliability Engineers (SRE)

- Infrastructure as Code (IaC) specialists

Quality Assurance Professionals

- Manual QA testers

- Automation engineers (Selenium, Cypress, Playwright)

- Performance testing specialists

- Security testing experts

2. Sales and Business Development

Colombian professionals in sales roles bring cultural awareness, strong communication skills, and a customer-centric approach that resonates well with North American and European markets. Many sales professionals in Colombia have experience working with international clients and understand the nuances of cross-border business relationships.

Sales Development Representatives (SDRs)

- Outbound prospecting specialists

- Lead qualification experts

- Cold calling and email outreach professionals

- CRM management specialists (Salesforce, HubSpot)

Account Executives and Sales Managers

- B2B sales closers

- Enterprise account managers

- Sales team leaders and managers

- Territory sales representatives

Business Development Professionals

- Partnership development managers

- Market expansion specialists

- Strategic alliance coordinators

- Channel sales managers

3. Marketing and Creative Services

Colombia’s creative sector has flourished in recent years, producing marketing professionals who combine analytical thinking with creative execution. The country’s bilingual talent pool is particularly valuable for companies targeting both English and Spanish-speaking markets.

Digital Marketing Specialists

- Performance marketing experts

- Marketing automation specialists (Marketo, Pardot)

- Email marketing managers

- Conversion rate optimization (CRO) specialists

SEO and SEM Experts

- Organic search specialists

- Google Ads and PPC managers

- Local and international SEO strategists

- Technical SEO analysts

Social Media Professionals

- Social media managers and strategists

- Community managers

- Paid social advertising specialists (Facebook, Instagram, LinkedIn, TikTok)

- Influencer marketing coordinators

Content Creators and Designers

- Copywriters (bilingual English/Spanish)

- Video editors and motion graphics designers

- Graphic designers and brand specialists

- Content strategists and managers

- Podcast producers and audio editors

4. Finance and Accounting

Colombian finance professionals are known for their attention to detail, understanding of international accounting standards, and ability to navigate both local and global financial regulations. Many have certifications in international accounting frameworks and experience with US GAAP or IFRS.

Accounting Professionals

- Staff accountants and senior accountants

- Accounts payable/receivable specialists

- Bookkeepers with QuickBooks and Xero expertise

- Tax specialists familiar with international tax law

Financial Analysts and Controllers

- Financial planning and analysis (FP&A) professionals

- Budget analysts

- Financial controllers

- Investment analysts

- Treasury specialists

5. Human Resources and People Operations

As remote work has become standard, Colombian HR professionals have developed expertise in managing distributed teams, implementing people-first cultures, and navigating the complexities of international employment.

HR Specialists and Generalists

- Talent acquisition specialists and recruiters

- HR business partners

- Employee relations specialists

- Compensation and benefits analysts

- HR compliance officers

People Operations Professionals

- Onboarding coordinators

- Learning and development specialists

- Performance management experts

- Employee engagement managers

- HRIS administrators (Workday, BambooHR, Gusto)

6. Customer Support and Success

Colombia has become a leading destination for customer support operations, thanks to its neutral Spanish accent, growing English proficiency, and service-oriented culture. The country’s time zone alignment with North America makes it particularly attractive for companies serving US and Canadian customers.

Customer Service Representatives

- Bilingual support agents (English/Spanish)

- Technical support specialists

- Chat and email support professionals

- Phone support representatives

- Tier 1 and Tier 2 support agents

Customer Success Professionals

- Customer success managers

- Onboarding specialists

- Account managers

- Retention specialists

- Customer education coordinators

Virtual Assistants and Administrative Support

- Executive assistants

- Calendar and email management specialists

- Data entry professionals

- Research assistants

- Travel coordinators

7. Operations and Project Management

Colombian operations professionals bring strong organizational skills, problem-solving abilities, and experience managing complex projects across multiple time zones.

Project Managers

- Agile/Scrum masters

- Technical project managers

- PMO specialists

- Program managers

- Product owners

Operations Coordinators

- Supply chain coordinators

- Logistics specialists

- Operations analysts

- Process improvement specialists

- Inventory managers

Business Process Outsourcing (BPO) Professionals

- Back-office processing specialists

- Claims processing agents

- Document processing specialists

- Transaction processing experts

8. Data and Analytics

As businesses become increasingly data-driven, Colombian universities have responded by producing graduates with strong quantitative skills and expertise in modern data tools and methodologies.

Data Professionals

- Data analysts and business intelligence analysts

- Data engineers

- Data scientists

- Machine learning engineers

- Database developers and architects

Analytics Specialists

- Business analysts

- Product analysts

- Marketing analytics specialists

- Web analytics experts (Google Analytics, Adobe Analytics)

9. Design and User Experience

Colombia’s design community has gained international recognition for its creativity and user-centered approach, making it an excellent source of design talent.

Design Professionals

- UI/UX designers

- Product designers

- Visual designers

- Interaction designers

- Design researchers

- Prototyping specialists (Figma, Sketch, Adobe XD)

Why These Roles Thrive in Colombia

The diversity and quality of talent available when you hire in Colombia stem from several factors:

Strong Educational Infrastructure: Colombia’s universities produce over 25,000 engineering graduates annually, with specialized programs in software development, business administration, and technical fields.

Growing Tech Ecosystem: Government initiatives and private investment have created innovation hubs and tech parks, fostering a culture of entrepreneurship and technical excellence.

Language Skills: Increasing emphasis on bilingual education means many professionals, particularly in younger generations, possess strong English skills alongside native Spanish proficiency.

Cost-Effective Talent: Salaries in Colombia typically range from 40-60% lower than comparable US positions, while maintaining high quality standards.

Cultural Alignment: Colombian professionals share cultural and business values with North American companies, including strong work ethics, collaborative mindsets, and customer service orientation.

These factors combine to make Colombia an increasingly attractive destination for companies seeking to build remote teams, establish nearshore operations, or expand their global talent footprint. Whether you’re looking to hire in Colombia for technical roles, creative positions, or operational support, the country offers a deep talent pool capable of meeting diverse business needs.

Monthly Salary Ranges When You Hire in Colombia (USD)

Salaries when you hire in Colombia are highly competitive compared to the U.S. and Europe, offering businesses the opportunity to access top-tier talent at a fraction of the cost:

Note: These salaries reflect gross monthly compensation and may vary based on city, skill set, and language proficiency when you hire in Colombia. Hiring through an Employer of Record (EOR) or direct contract can also influence final cost.

3 Legal Ways to Hire in Colombia

When considering how to hire in Colombia, businesses have three primary pathways: engaging contractors, using Employer of Record (EOR) services, or establishing a local legal entity.

1. Hiring Contractors in Colombia

Engaging contractors is often the simplest way to quickly bring talent on board, particularly for short-term or project-specific roles. Contractors work as independent entities, managing their own taxes and benefits.

PROS

- Flexibility for short-term projects or fluctuating workloads

- Cost-effective with no obligation to provide benefits

- Minimal paperwork and no local entity required

CONS

- Compliance risks if workers are misclassified

- Limited control over contractors compared to employees

- May not attract top talent seeking stability and benefits

When hiring contractors in Colombia, have a solid contract that clearly outlines the scope of work, payment terms, and any confidentiality requirements. The most important thing is understanding the difference between contractors and employees under Colombian law—misclassifying workers can lead to serious penalties.

2. Employer of Record (EOR) Services in Colombia

An Employer of Record acts as the legal employer for your Colombian workforce, enabling you to hire full-time workers without establishing a legal entity. The EOR manages payroll, taxes, benefits, and compliance on your behalf.

PROS

- Ensures compliance with local labor laws and regulations

- Enables quick onboarding without complex legal processes

- Reduces administrative burden by handling HR, payroll, and benefits

CONS

- Monthly service fees per employee increase operational costs

- Less direct control as the EOR is the legal employer

This approach works well if you’re testing the Colombian market or only need to hire a handful of employees. You get all the benefits of compliant, full-time employment without the headache and expense of setting up your own company.

3. Establishing a Local Entity in Colombia

Creating a local entity allows you to directly hire employees and manage operations independently. This option is best for companies planning a long-term presence in Colombia.

PROS

- Direct control over hiring, payroll, benefits, and employment terms

- Strengthens local brand presence in the Colombian market

- Supports strategic growth for businesses planning to scale

CONS

- Time-intensive setup process taking several months

- Higher costs for registration, legal fees, and ongoing compliance

- Requires navigating Colombia’s legal, tax, and regulatory environment

This option makes sense when you’re committed to building a substantial team and want complete operational control, but be prepared for the upfront investment in time and money.

Employment Compliance When You Hire in Colombia

Hiring employees in Colombia requires strict adherence to local labor laws. Understanding the types of contracts, statutory benefits, and payroll obligations is essential to staying compliant and avoiding costly penalties.

Understanding Colombian Labor Law

Employment contracts in Colombia are regulated by the Substantive Labor Code (Código Sustantivo del Trabajo, 1951). All contracts must be in writing and clearly specify the role, salary, working hours, benefits, and termination clauses.

Types of Employment Contracts

Fixed-Term Contracts: Set for a defined period, typically 6 to 12 months. These can be renewed up to three times before automatically converting to indefinite-term contracts.

Indefinite-Term Contracts: No specified end date, offering employees greater job security. These are preferred for long-term positions.

Temporary or Casual Contracts: Used for seasonal work or specific projects. Must clearly define the task and expected duration.

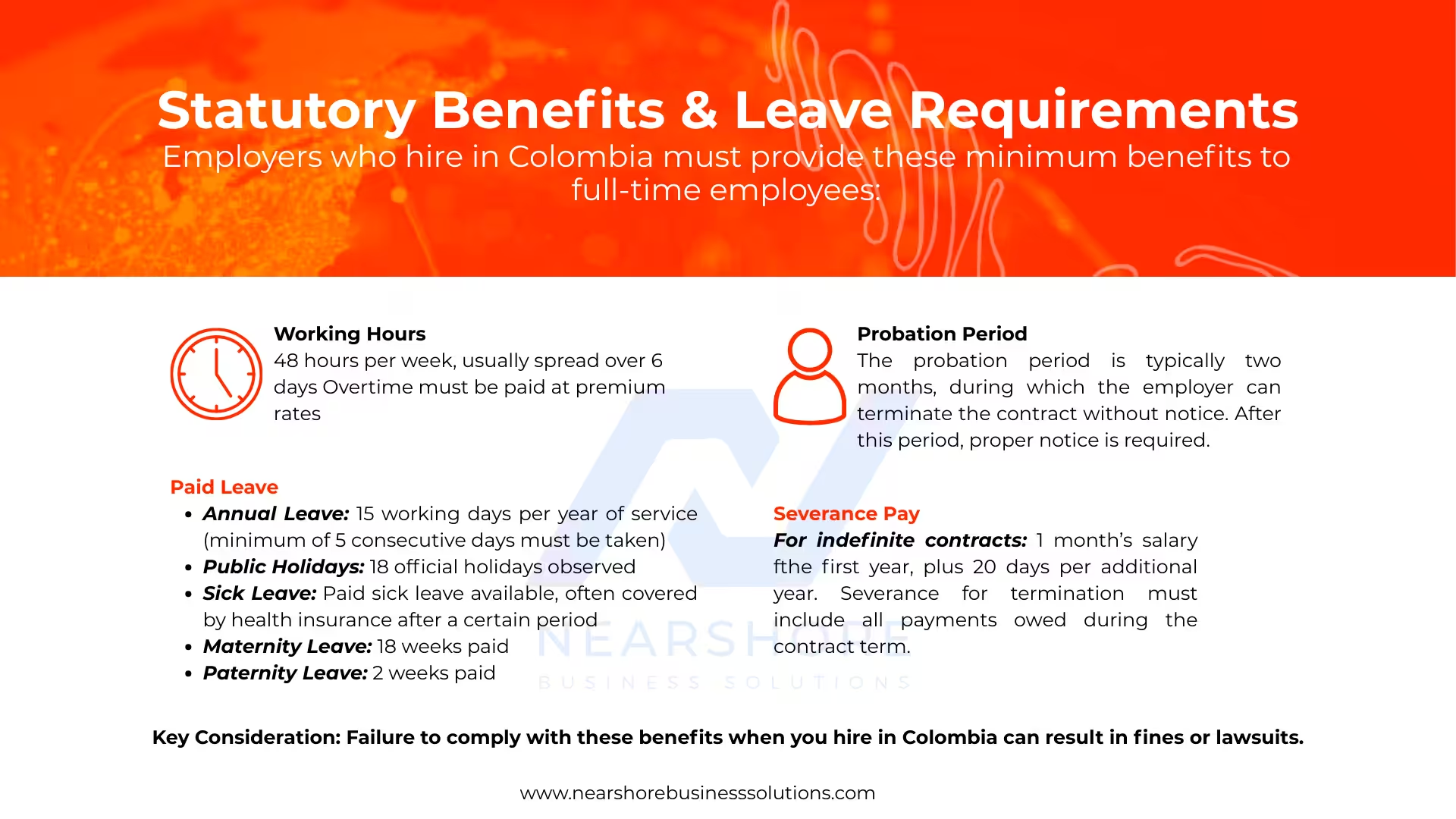

Statutory Benefits & Leave Requirements in Colombia

Employers must provide these minimum benefits to all full-time employees:

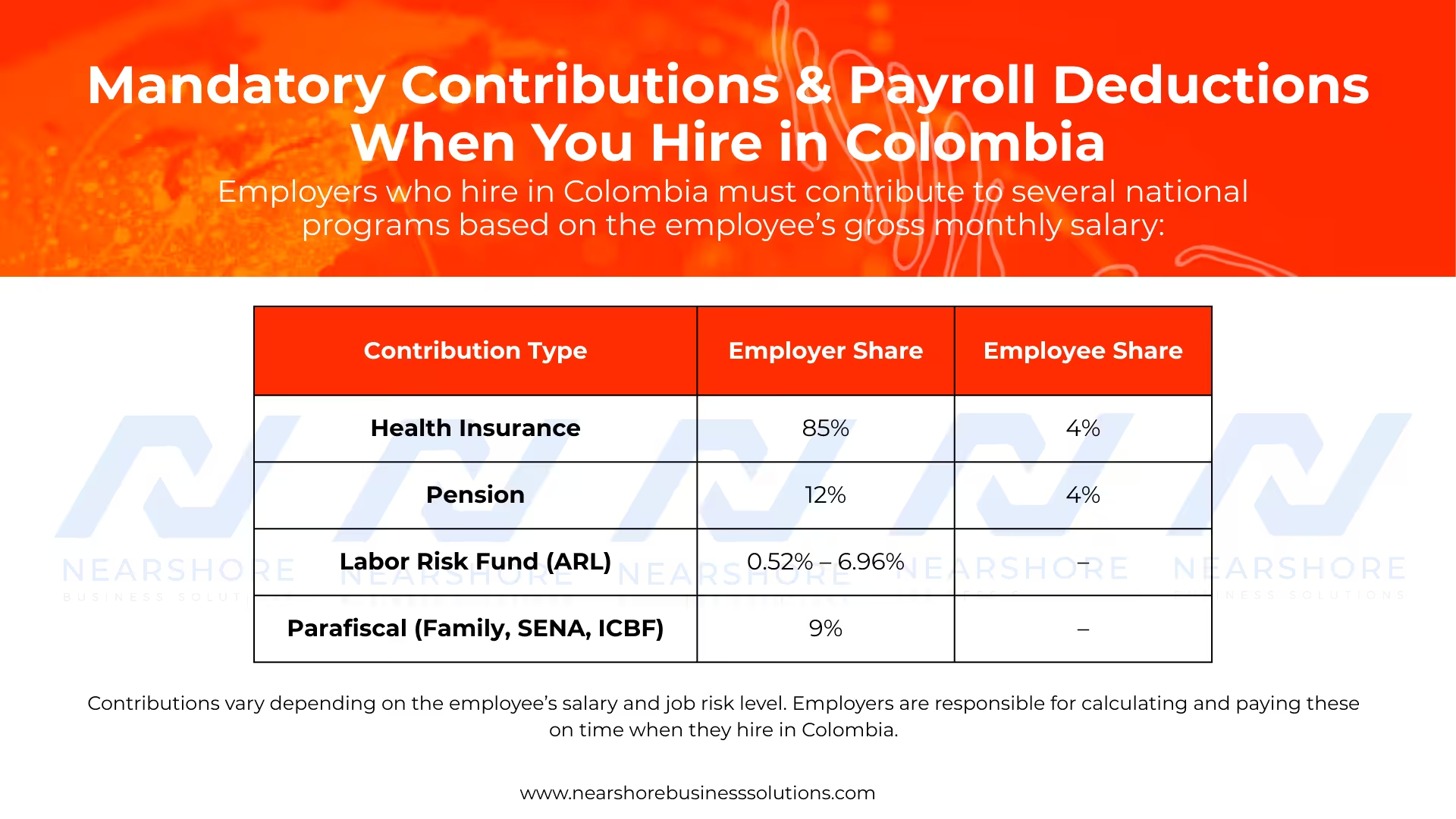

Mandatory Contributions & Payroll Deductions in Colombia

Employers must contribute to several national programs based on each employee’s gross monthly salary:

Contributions vary based on salary levels and job risk classification. Employers are responsible for calculating and remitting these payments on time, typically on a monthly basis.

How to Set Up a Business to Hire in Colombia

For companies planning a long-term presence with direct employee hiring, establishing a legal entity is necessary.

Types of Business Structures

Simplified Stock Company (S.A.S.): The most popular and flexible structure in Colombia. Can be formed by a single shareholder and provides limited liability protection.

Limited Liability Company (Ltda.): Requires at least two shareholders with liability limited to capital contributions.

Corporation (S.A.): A more complex structure requiring at least five shareholders, typically used by larger enterprises.

Registration Steps

- Select a Company Name: Conduct a name search through the Chamber of Commerce to ensure availability

- Draft and Sign Bylaws: Outline the company’s structure, management, and governance (must be notarized)

- Register with the Chamber of Commerce: Submit incorporation documents for official registration

- Obtain a Tax Identification Number (NIT): Register with the Colombian tax authority (DIAN)

- Open a Corporate Bank Account: Required for business operations and payroll processing

The registration process typically takes several weeks. Working with local legal or accounting firms can help navigate complexities and ensure compliance.

Ongoing Compliance Requirements

Once your business is operational, maintaining compliance with local regulations is essential.

Annual Compliance Obligations

Tax Filings: Submit annual corporate income tax returns to DIAN. VAT returns are typically filed monthly or bimonthly.

Financial Statements: Prepare and file annual financial statements with the Chamber of Commerce following International Financial Reporting Standards (IFRS).

Statutory Audit: Depending on company size, Colombian law may require an external auditor (Revisor Fiscal).

Social Security Contributions: Remit employee contributions monthly, ensuring accurate calculations and timely payments.

Key Compliance Risks

Labor Law Violations: Failing to provide statutory benefits like paid leave, health insurance, and social security contributions can result in fines and legal action.

Tax Non-Compliance: Missing tax deadlines or incorrect filings can lead to substantial penalties.

Employee Misclassification: Treating employees as independent contractors when they should be classified as employees carries serious legal and financial consequences.

Workplace Safety: Employers must maintain safe working conditions and comply with occupational risk regulations.

Regular internal audits help ensure ongoing compliance with Colombia’s evolving labor laws and regulations.

How to Legally Terminate Employees in Colombia

Termination requires just cause (gross misconduct, repeated poor performance, breach of contract) or mutual agreement. Under Law 2466 of 2025, disciplinary terminations must follow strict “Due Process”: provide formal written notification and allow a minimum 5-day defense period for the employee to respond.

Severance Pay

Without just cause, employers must pay 30 days’ salary for the first year of service plus 20 days for each additional year (indefinite contracts). Fixed-term contracts may have different terms based on the contract agreement.

Notice Period

Provide 30 days’ notice for indefinite-term contracts. Fixed-term contracts follow the notice requirements specified in the agreement.

Final Payments

Upon termination, pay all outstanding amounts: unpaid salary, unused vacation days (15 business days per year), accumulated cesantías (severance deposits), Prima bonuses, and 12% interest on cesantías. Failure to pay results in legal claims and penalties.

Mutual Termination

Get mutual terminations in writing with clear terms on severance and benefits. While not legally required, offering severance helps avoid disputes.

Frequently Asked Questions About Hiring in Colombia

How much does it cost to hire employees in Colombia?

The 2026 minimum wage is COP 2,000,000 monthly (approximately $533 USD), which includes the base salary of COP 1,750,905 plus the connectivity allowance of COP 249,095. Skilled professionals typically earn between $1,000-$6,000 USD monthly depending on experience and role. Employers must budget for Total Employer Cost (TEC) that’s 40-52% above base salary due to mandatory social security contributions (approximately 21-28%) and statutory benefits like vacation, bonuses, and severance deposits.

What is the average salary in Colombia?

The national average salary in 2026 is approximately COP 4,500,000 ($1,200 USD) monthly, though this varies significantly by city and role. Junior developers earn COP 4.8M-5.5M ($1,280-$1,467 USD), mid-level professionals earn COP 6.0M-8.0M ($1,600-$2,133 USD), and senior specialists can earn COP 9.0M-16.0M ($2,400-$4,267 USD). Bilingual professionals command 20-40% premiums over Spanish-only counterparts.

What is the best way to hire employees in Colombia?

The best approach depends on your timeline and growth strategy. For rapid market entry, use an Employer of Record (EOR) to handle compliance and payroll within 3-7 business days. For project-based work, hire independent contractors for flexibility. For long-term operations, establish a local Simplified Stock Company (S.A.S.), which takes 6-10 weeks but provides full operational control. Most companies start with an EOR while planning entity formation.

Can I hire remote workers in Colombia without a local entity?

Yes, you can hire without establishing a local entity using an Employer of Record (EOR) or independent contractors. An EOR acts as the legal employer, managing all compliance including payroll, taxes, health insurance (8.5% employer contribution), pension (12%), and parafiscal contributions while you direct daily work. This enables compliant full-time hiring within 3-7 business days. Note that remote workers earning up to 2x minimum wage (COP 3,501,810 in 2026) are entitled to the connectivity allowance (COP 249,095).

How do I hire contractors in Colombia?

Draft a clear independent contractor agreement specifying scope of work, deliverables, payment terms, and duration. Contractors must have autonomy over their work, use their own equipment, and typically serve multiple clients. They’re responsible for their own tax filings and social security. The critical risk is misclassification—if contractors work exclusively for you, follow set schedules, or function like employees, Colombian authorities may reclassify them, resulting in penalties and retroactive payment of all employee benefits and contributions.

What are the labor laws I need to know when hiring in Colombia?

As of July 15, 2026, the standard workweek is 42 hours (reduced from 44 hours). Night work now starts at 7:00 PM (changed from 9:00 PM) and requires a 35% surcharge. Sunday and holiday work requires a 90% surcharge in 2026 (increasing to 100% in 2027). Employees receive 15 business days of paid vacation, 18 paid national holidays, Prima bonus (one month’s salary paid twice yearly), and mandatory severance deposits (Cesantías). New in 2026: remunerated leave for marriage (3 days), medical appointments, and school commitments.

How long does it take to hire employees in Colombia?

Using an EOR: 3-7 business days after selecting candidates.

Hiring Contractors: 1-3 days after finalizing the contract.

Establishing a Local Entity (S.A.S.): 6-10 weeks for complete incorporation, including Chamber of Commerce registration, obtaining a NIT from DIAN, and opening a corporate bank account. After entity setup, individual hiring takes 1-2 weeks.

What is the minimum wage in Colombia in 2026?

The 2026 minimum wage is COP 1,750,905 monthly (approximately $467 USD), representing a 23% increase from 2025. Additionally, employees working remotely who earn up to 2x the minimum wage receive a mandatory connectivity allowance of COP 249,095, bringing the total minimum to COP 2,000,000 ($533 USD). This allowance covers home internet and utility costs for remote work.

Do I need to pay taxes when hiring employees in Colombia?

Yes. Employers contribute 8.5% for health insurance and 12% for pension, while withholding 4% from employees for each. Additional obligations include labor risk insurance (0.522-6.96% based on risk class), Family Welfare/ICBF (3%), apprenticeship/SENA (2%), and compensation fund (4%). Total recurring employer costs range from 21-28% of salary. Note: Most corporate entities are exempt from the 8.5% health contribution and 5% SENA/ICBF for employees earning less than 10x minimum wage (COP 17,509,050 in 2026).

Is it expensive to hire employees in Colombia?

No, hiring in Colombia remains cost-effective. With Total Employer Cost typically 40-52% above base salary, total employment costs are still 40-70% lower than comparable North American positions. For example, a mid-level developer earning $60,000-$100,000 in the US might earn $19,200-$32,000 annually in Colombia (COP 6.0M-10.0M monthly) with similar skills, providing significant savings even with mandatory contributions.

What benefits am I required to provide employees in Colombia?

Required benefits include Prima de Servicios (one month’s salary per year paid in two installments), Cesantías (monthly severance deposit equal to 8.33% of salary), 12% annual interest on cesantías, 15 business days of paid vacation, 18 paid national holidays, and paid sick leave. New in 2026: remunerated leave for marriage (3 days), medical appointments, school commitments, sustainable mobility (bicycle commuting), and legal citations. Maternity leave (18 weeks) and paternity leave (2 weeks) remain mandatory.

What is an Employer of Record (EOR) and how does it work in Colombia?

An EOR becomes the legal employer of your Colombian workforce, handling all compliance including payroll processing, tax withholding and remittance (health 8.5%, pension 12%, parafiscal 9%), benefits administration, and adherence to Law 2466 of 2025 labor reforms. You maintain control over daily work and performance management. EORs typically charge $200-$600 monthly per employee and enable compliant hiring within 3-7 days without entity formation.

How do I set up a company in Colombia to hire employees?

The Simplified Stock Company (S.A.S.) is the most popular structure, requiring only one shareholder with limited liability. The process includes: name search through Chamber of Commerce, drafting and notarizing bylaws, official registration, obtaining a Tax Identification Number (NIT) from DIAN, and opening a corporate bank account. The process takes 6-10 weeks and costs $2,000-$5,000 including legal fees. Local legal counsel ensures compliance with the 2025 labor reforms.

Can I hire bilingual employees in Colombia?

Yes, Colombia produces approximately 120,000 university graduates annually with strong STEM and ICT emphasis. Bilingual professionals are concentrated in Bogotá (7.9 million population), Medellín, Barranquilla, and Cali. English proficiency is particularly strong in tech, customer service, and business sectors. Bilingual professionals command 20-40% salary premiums. With 92% mobile internet coverage and 95% literacy rates, the workforce is highly connected and educated.

What are the working hours and overtime laws in Colombia?

Starting July 15, 2026, the standard workweek reduces to 42 hours (from 44 hours). This increases the ordinary hourly rate from COP 7,959 to COP 8,338 for minimum wage employees. Overtime requires premium pay: 25% for daytime and 75% for nighttime. Night work (starting at 7:00 PM as of December 2025) receives a 35% surcharge even within regular hours. Sunday and holiday work requires a 90% surcharge in 2026 (increasing to 100% in 2027).

How do I terminate an employee in Colombia?

Termination requires just cause or mutual agreement. Law 2466 of 2025 mandates strict “Due Process” for disciplinary terminations: formal written notification and minimum 5-day defense period for the employee. Without just cause, pay indemnity of 30 days’ salary for the first year plus 20 days per additional year for indefinite contracts. All final payments must include unpaid salary, unused vacation (15 business days per year), accumulated cesantías, outstanding Prima payments, and 12% interest on cesantías.

What are the risks of misclassifying employees as contractors in Colombia?

Misclassification violates the Substantive Labor Code and can result in retroactive payment of all statutory benefits (Prima, cesantías, vacation), back payment of employer contributions (21-28% of salary), significant fines from labor authorities, and legal claims. Colombian law examines the actual relationship—autonomy, equipment ownership, exclusivity, and schedule control. Given the 2025 labor reforms strengthening worker protections, proper classification is more critical than ever.

What is the best city in Colombia to hire employees?

Bogotá (population 7.9 million) offers the largest talent pool with 15% of the national population, ideal for finance, tech, and professional services. Medellín is Colombia’s innovation hub with thriving tech ecosystems and competitive salaries. Cali and Barranquilla excel in customer support and BPO services with strong English proficiency and lower salary expectations. Many companies hire across multiple cities to access diverse talent pools.

How does Colombia compare to other nearshore locations like Mexico or Argentina?

Colombia operates on GMT-5, providing year-round alignment with US Eastern Time (no daylight saving changes). The workforce of 24.6 million has reached a record-low 7.0% unemployment rate (November 2025), indicating a competitive but stable labor market. With 92% mobile internet coverage and robust digital infrastructure investment by MinTIC, Colombia offers superior connectivity compared to many regional competitors. The 2025 labor reforms have elevated compliance standards, positioning Colombia as a high-standard nearshore destination.

Ready to Hire in Colombia?

Colombia in 2026 has evolved into a premier, compliance-intensive destination for global talent acquisition. With a workforce of 24.6 million professionals, record-low 7.0% unemployment, and seamless GMT-5 time zone alignment, the country offers significant strategic advantages for companies building nearshore operations.

The regulatory landscape has fundamentally shifted with Law 2466 of 2025 (Labor Reform for Decent and Dignified Work). Key changes include the COP 2,000,000 minimum wage floor, 42-hour workweek starting July 15, 2026, night work commencing at 7:00 PM with 35% surcharge, and progressive Sunday/holiday surcharges reaching 90% in 2026. New mandatory remunerated leaves for marriage, medical appointments, and school commitments reflect Colombia’s alignment with International Labour Organization (ILO) standards.

Successfully hiring requires budgeting for Total Employer Cost of 40-52% above base salary, understanding the phased working hours reduction under Law 2101, and following strict “Due Process” for employee terminations. Employers must navigate health insurance (8.5%), pension (12%), and parafiscal contributions (9%), though corporate exemptions exist for employees earning under 10x minimum wage.

Your entry options remain flexible: engage contractors for project work (with careful attention to classification), partner with an EOR for 3-7 day compliant hiring, or establish an S.A.S. entity for long-term control. Most successful companies test the market via EOR before committing to entity formation.

Colombia’s 120,000 annual graduates, 95% literacy rate, 92% mobile internet coverage, and maturing workforce of 53.4-53.7 million position it as Latin America’s most dynamic talent market. However, the era of low-compliance hiring has ended—precision in regulatory adherence is now essential for success.

How Can We Help You?

Whether you’re hiring your first role in Colombia or scaling an entire team, we support U.S. companies at every stage of the hiring journey:

- Remote Talent Recruitment – End-to-end recruiting for remote hires in Colombia, including market benchmarking, vetting, and candidate selection.

- In-Country Recruitment – Local, country-specific recruitment for companies building teams directly in Colombia.

- Recruitment as a Service (RaaS) – An embedded recruiting model where our team operates as an extension of yours to support ongoing or multi-role hiring needs.

- Staff Augmentation – Dedicated nearshore talent that integrates directly into your workflows, allowing you to scale teams quickly and predictably.

Ready to get started?

Tell us what roles you’re hiring for, and we’ll help you understand market availability, salary ranges, and the best hiring model for your team.