Nicaragua is becoming an emerging destination for companies looking to hire in Nicaragua and expand their remote teams in Latin America. With its cost-effective labor market, growing professional workforce, and strategic time zone alignment with North America, Nicaragua provides unique opportunities for businesses seeking skilled talent.

This guide will walk you through everything you need to know when you hire in Nicaragua. From understanding different hiring methods and navigating labor laws to managing payroll, taxes, and compliance, this comprehensive guide will simplify your approach. Whether you’re onboarding contractors or setting up a local entity, this guide will help you efficiently and compliantly hire in Nicaragua.

Key Stats About Hiring in Nicaragua

Language: Spanish (English proficiency is increasing in urban and business sectors)

Time Zone: GMT-6 (similar to U.S. Central Standard Time, no Daylight Saving Time)

Currency: Nicaraguan Córdoba (NIO), but U.S. dollars are widely accepted

Population: Approximately 6.8 million

Major Cities for Talent: Managua, León, Granada

Internet Penetration: Over 50%, with reliable connectivity in urban centers

Labor Force: Approximately 3.4 million, focused on services, agriculture, and manufacturing

Education: High literacy rate (83%) with increasing emphasis on STEM and business education

Why Hire in Nicaragua?

When you hire in Nicaragua, you gain access to an affordable and rapidly growing workforce for businesses looking to expand with skilled professionals in Latin America. Here’s why you should hire in Nicaragua for your remote teams:

Cost-Effective Labor

Nicaragua has one of the most competitive labor costs in Latin America, making it an attractive option for businesses looking to reduce hiring expenses while maintaining quality when they hire in Nicaragua.

Skilled Workforce

Nicaragua’s workforce is expanding in key industries such as technology, customer service, manufacturing, and agriculture. Major cities like Managua and León are home to universities producing skilled graduates, making it easier to hire in Nicaragua.

Time Zone Alignment

With its GMT-6 time zone, Nicaragua aligns closely with U.S. Central Standard Time, allowing seamless collaboration with North American teams when you hire in Nicaragua.

Growing Infrastructure

Urban centers in Nicaragua have reliable internet connectivity, essential for remote work. Additionally, digital infrastructure is improving to meet the growing needs of global businesses that hire in Nicaragua.

Cultural Compatibility

Nicaraguans share a strong work ethic, professionalism, and adaptability, aligning well with North American business practices. The widespread use of the U.S. dollar in business transactions simplifies financial management for U.S.-based companies that hire in Nicaragua.

3 Ways to Hire in Nicaragua

1. Hiring Contractors in Nicaragua

Hiring independent contractors is a flexible solution for businesses looking to quickly onboard talent for short-term or project-based work when they hire in Nicaragua. Contractors operate as self-employed individuals and manage their own taxes and benefits.

PROS

- Flexibility: Suitable for short-term or project-based roles

- Cost-Effective: No requirement to provide benefits or social security contributions

- Simplicity: Requires minimal paperwork and no legal entity setup

CONS

- Compliance Risks: Misclassifying employees as contractors can result in fines or legal issues

- Limited Commitment: Contractors may not provide long-term stability

- Talent Attraction: Top candidates may prefer full-time roles with benefits

Key Considerations: Businesses must clearly define work terms, deliverables, and payment conditions in a contract to ensure compliance and avoid misclassification when they hire in Nicaragua.

2. Employer of Record (EOR) Services to Hire in Nicaragua

An Employer of Record (EOR) acts as the legal employer, handling payroll, taxes, benefits, and compliance while allowing you to manage daily activities. This option is ideal for companies looking to hire in Nicaragua with full-time employees without setting up a local entity.

PROS

- Compliance: Ensures adherence to local labor and tax regulations

- Quick Onboarding: Simplifies the hiring process, enabling fast market entry

- Reduced Administration: EOR manages payroll, benefits, and HR functions

CONS

- Service Costs: EOR fees add to operational expenses

- Indirect Control: Employment decisions must go through the EOR

Key Considerations: EOR services are ideal for businesses looking to hire in Nicaragua with small teams or testing the Nicaraguan market without the complexities of entity formation.

3. Entity Formation When You Hire in Nicaragua

Establishing a legal entity allows businesses to hire in Nicaragua directly with employees and maintain full operational control. This approach is suited for companies planning long-term investment and larger-scale hiring.

PROS

- Full Control: Directly manage employees, payroll, and benefits

- Brand Presence: Strengthen local reputation and market presence

- Long-Term Growth: Suitable for companies scaling their operations

CONS

- Time-Consuming: Incorporation involves administrative and legal processes

- Higher Costs: Includes setup fees, operational expenses, and ongoing compliance

- Complexity: Requires navigating Nicaragua’s labor and tax regulations

Key Considerations: Setting up a legal entity involves registering with the Nicaraguan Public Registry, obtaining a tax identification number (RUC), and complying with labor laws. Local legal advisors can streamline the process when you hire in Nicaragua.

Labor Laws and Employment Contracts When You Hire in Nicaragua

Understanding Nicaragua’s labor laws is essential to ensure compliance and maintain fair employment practices when you hire in Nicaragua.

Types of Employment Contracts

Indefinite-Term Contract: The default contract for permanent positions with no set end date

Fixed-Term Contract: Used for temporary or project-based work with a defined duration

Part-Time Contract: Applicable for roles with fewer working hours than a standard workweek

Key Considerations: All employment contracts must be in writing, detailing job duties, salary, working hours, benefits, and termination terms when you hire in Nicaragua.

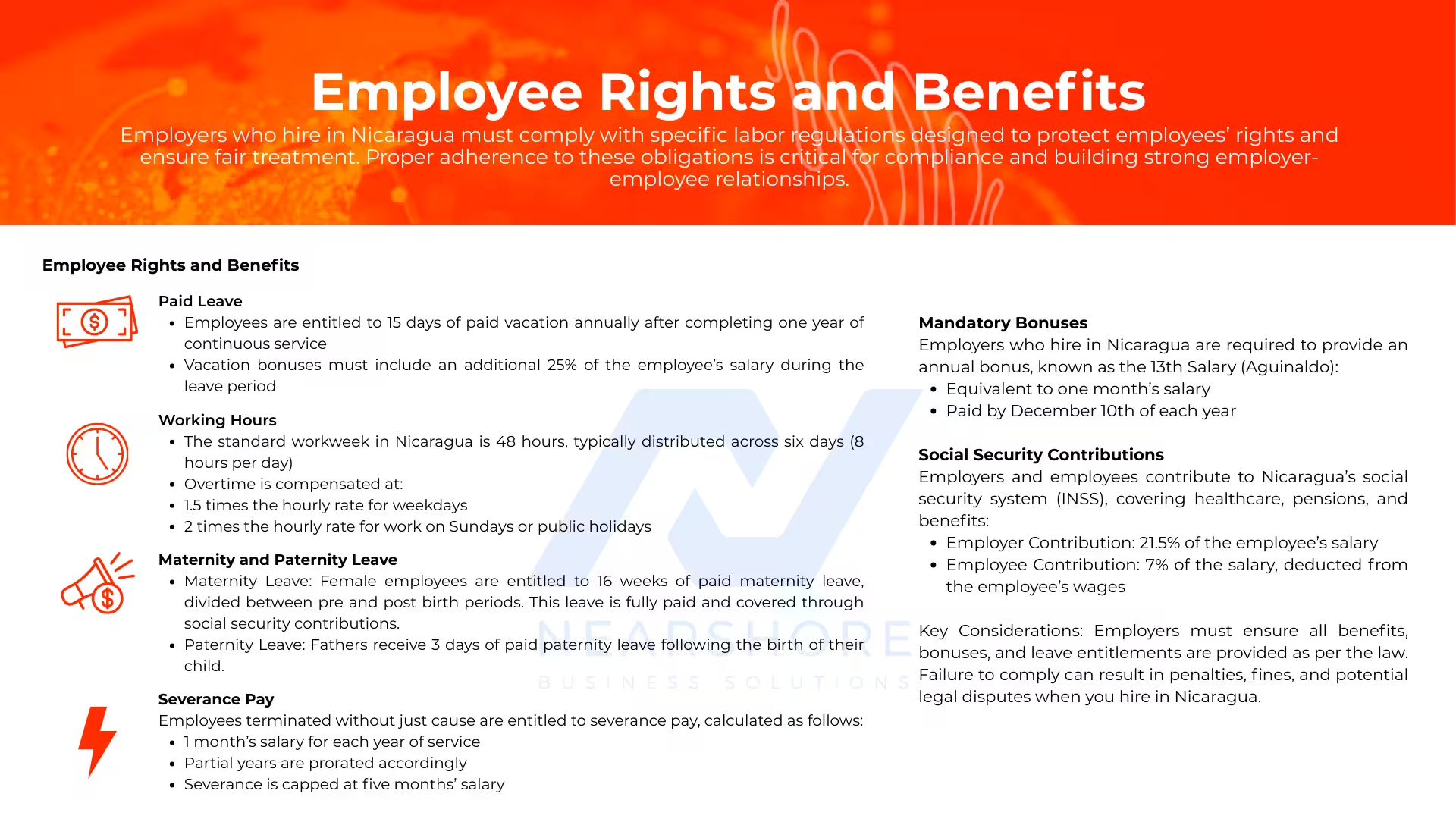

Employee Rights and Benefits

Employers who hire in Nicaragua must comply with specific labor regulations designed to protect employees’ rights and ensure fair treatment. Proper adherence to these obligations is critical for compliance and building strong employer-employee relationships.

Working Hours

- The standard workweek in Nicaragua is 48 hours, typically distributed across six days (8 hours per day)

- Overtime is compensated at:

- 1.5 times the hourly rate for weekdays

- 2 times the hourly rate for work on Sundays or public holidays

Paid Leave

- Employees are entitled to 15 days of paid vacation annually after completing one year of continuous service

- Vacation bonuses must include an additional 25% of the employee’s salary during the leave period

Public Holidays

Nicaragua recognizes 9 national public holidays, which are paid days off for employees:

- January 1 – New Year’s Day

- Holy Thursday and Good Friday – Variable dates in March/April

- May 1 – Labor Day

- July 19 – Revolution Day

- September 14 – Battle of San Jacinto

- September 15 – Independence Day

- December 8 – Immaculate Conception

- December 25 – Christmas Day

Maternity and Paternity Leave

Maternity Leave: Female employees are entitled to 12 weeks of paid leave, starting four weeks before the due date and extending eight weeks after delivery. The leave is paid through the Nicaraguan Social Security Institute (INSS).

Paternity Leave: Male employees are entitled to 5 days of paid leave following the birth of a child.

Severance Pay

Employees terminated without just cause are entitled to severance pay, calculated as follows:

- 1 month’s salary for each year of service

- Partial years are prorated accordingly

- Severance is capped at five months’ salary

Mandatory Bonuses

Employers who hire in Nicaragua are required to provide an annual bonus, known as the 13th Salary (Aguinaldo):

- Equivalent to one month’s salary

- Paid by December 10th of each year

Social Security Contributions

Employers and employees contribute to Nicaragua’s social security system (INSS), covering healthcare, pensions, and benefits:

- Employer Contribution: 21.5% of the employee’s salary

- Employee Contribution: 7% of the salary, deducted from the employee’s wages

Key Considerations: Employers must ensure all benefits, bonuses, and leave entitlements are provided as per the law. Failure to comply can result in penalties, fines, and potential legal disputes when you hire in Nicaragua.

Payroll, Benefits and Compensation When You Hire in Nicaragua

Effectively managing payroll when you hire in Nicaragua requires strict compliance with local regulations, including salary structures, mandatory bonuses, and social security contributions.

Salary Structure

Minimum Wage: The minimum wage in Nicaragua varies by industry but averages approximately $225 USD per month as of 2025.

Mandatory Bonuses: Employers must pay the 13th salary (Aguinaldo) annually by December.

Allowances: While not mandatory, companies may offer allowances for transportation, meals, or housing to remain competitive when they hire in Nicaragua.

Mandatory Benefits

Employers must contribute the following percentages to Nicaragua’s social security system (INSS):

- Health and Pension Contributions: Employers contribute 21.5% of the employee’s salary

- Employee Contributions: Deduct 7% from the employee’s gross salary

Payment Cycles

- Salaries are typically paid on a monthly basis. Some companies opt for bi-weekly payments to improve employee cash flow

- Bonuses, including the Aguinaldo, must be paid according to legal deadlines

Deductions

- 7% of salaries for employee social security contributions

- Income tax, following Nicaragua’s progressive tax rates (ranging from 0% to 30%)

Key Considerations: Timely and accurate salary payments, bonuses, and contributions are critical for compliance when you hire in Nicaragua. Partnering with a local payroll provider can simplify processes and reduce risks.

Navigating Taxes and Legal Compliance to Hire in Nicaragua

Businesses that hire in Nicaragua must comply with the country’s tax structure, social security system, and employment-related legal obligations.

Corporate Taxes

Corporate Income Tax: The standard corporate income tax rate is 30% of net taxable income.

Value-Added Tax (VAT): A 15% VAT applies to most goods and services. Essential items like basic food products may be exempt.

Employment Taxes and Withholdings

- Deduct 7% of salaries for employee contributions to social security

- Remit 21.5% of salaries as the employer’s share of social security contributions

- Withhold income tax based on Nicaragua’s progressive tax rates (0% to 30%)

Data Protection and Privacy Regulations

While Nicaragua does not yet have comprehensive data protection laws, employers who hire in Nicaragua must handle employee data responsibly:

- Obtain written consent before collecting or processing personal information

- Use employee data exclusively for employment-related purposes

- Implement security measures to protect sensitive information from misuse or unauthorized access

Key Considerations: Compliance with corporate taxes, payroll obligations, and responsible data management is essential for avoiding legal penalties when you hire in Nicaragua. Working with local experts can streamline tax filings and ensure accuracy.

Company Formation and Setup to Hire in Nicaragua

For businesses planning a long-term presence and wanting to hire in Nicaragua, establishing a local entity is an effective option. Here’s an overview of the process and requirements:

Types of Business Entities

Limited Liability Company (S.R.L.): Suitable for small to medium-sized businesses, offering limited liability for shareholders.

Corporation (S.A.): Designed for larger companies, requiring a board of directors and additional governance.

Branch Office: Allows foreign companies to operate in Nicaragua under the parent company’s legal structure.

Registration Process

- Choose a Business Name: Verify availability through Nicaragua’s Public Registry

- Draft and Notarize Bylaws: Define the company’s operational structure, purpose, and governance

- Register with the Public Registry: Submit incorporation documents for approval

- Obtain a Tax Identification Number (RUC): Register with the Directorate General of Revenue (DGI)

- Register with Social Security (INSS): Ensure compliance with mandatory contributions for employees

- Open a Corporate Bank Account: Required for payroll management and business transactions

Key Considerations: The process can take several weeks. Partnering with local legal and accounting professionals ensures smooth setup and compliance when you hire in Nicaragua.

Compliance and Management When You Hire in Nicaragua

Ongoing compliance is essential for businesses that hire in Nicaragua. Companies must meet tax, labor, and financial reporting requirements to avoid penalties.

Annual Compliance Requirements

Tax Filings: File annual corporate income tax returns and remit monthly VAT payments to the DGI.

Social Security Contributions: Submit employer and employee contributions monthly to INSS.

Financial Reporting: Prepare and file annual financial statements in accordance with Nicaraguan regulations.

Working with Local Partners

Legal Advisors: Ensure employment contracts, tax filings, and legal requirements are met.

Accounting Firms: Manage bookkeeping, payroll, and financial reporting.

Payroll Providers: Streamline salary payments, bonuses, and compliance with mandatory contributions.

Leveraging Employer of Record (EOR) and Professional Employer Organization (PEO) Services to Hire in Nicaragua

For companies looking to hire in Nicaragua without setting up a local entity, EOR and PEO services provide a compliant and efficient alternative.

Employer of Record (EOR): An EOR acts as the legal employer, managing payroll, benefits, and compliance on your behalf, while you focus on daily tasks.

Professional Employer Organization (PEO): A PEO serves as a co-employer, handling HR, payroll, and compliance responsibilities while you manage employee operations.

Key Considerations: These services are ideal for businesses testing the Nicaraguan market or scaling teams without the administrative burden of forming a legal entity when they hire in Nicaragua.

Frequently Asked Questions About Hiring in Nicaragua

How much does it cost to hire in Nicaragua?

The cost to hire in Nicaragua is highly competitive compared to other Latin American countries. The minimum wage averages approximately $220 USD per month, though skilled professionals in technology and customer service typically earn between $500-$1,500 USD monthly. Employers must also budget for mandatory costs including 21.5% social security contributions, the 13th salary bonus (Aguinaldo), and vacation benefits. Overall, total employment costs when you hire in Nicaragua are 30-50% lower than hiring comparable talent in North America or Europe.

What is the best way to hire employees in Nicaragua?

The best way to hire in Nicaragua depends on your business needs and timeline. For quick market entry without a legal entity, using an Employer of Record (EOR) is ideal as they handle compliance, payroll, and benefits. For project-based or short-term work, hiring independent contractors offers flexibility. If you’re planning long-term operations and want full control, establishing a local entity is recommended. Most companies start with an EOR to test the market before committing to entity formation.

Can I hire remote workers in Nicaragua without a local entity?

Yes, you can hire in Nicaragua without establishing a local entity by using an Employer of Record (EOR) service or hiring independent contractors. An EOR acts as the legal employer, managing all compliance, payroll, taxes, and benefits while you direct the daily work. This allows you to compliantly hire full-time employees in Nicaragua within days. Contractors work as self-employed individuals, though you must ensure proper classification to avoid misclassification penalties.

What are the labor laws I need to know when hiring in Nicaragua?

When you hire in Nicaragua, key labor laws include: a 48-hour standard workweek, 15 days of paid vacation after one year, 9 paid public holidays, 12 weeks of paid maternity leave, 5 days of paternity leave, and mandatory severance pay for termination without cause (one month’s salary per year worked). Employers must pay the 13th salary bonus by December 10th and contribute 21.5% of salaries to social security. All employment contracts must be in writing and clearly detail terms, benefits, and termination conditions.

How long does it take to hire employees in Nicaragua?

The timeline to hire in Nicaragua varies by method. Using an Employer of Record (EOR), you can hire employees in as little as 2-5 business days once candidates are identified. Hiring contractors can be even faster, often within 1-3 days. However, if you’re establishing a local entity first, the incorporation process typically takes 4-8 weeks, including registration with the Public Registry, obtaining a tax identification number (RUC), and registering with social security (INSS). After entity setup, individual hiring can proceed within 1-2 weeks.

What is the minimum wage in Nicaragua?

The minimum wage in Nicaragua varies by industry sector but averages approximately $220 USD per month as of 2024. Different sectors have different minimum wage rates set by the government, with agriculture, manufacturing, and services each having specific minimums. However, skilled professionals in technology, customer service, and professional roles typically earn significantly above minimum wage, ranging from $500-$1,500 USD monthly depending on experience and specialization.

Do I need to pay taxes when I hire in Nicaragua?

Yes, when you hire in Nicaragua, you must comply with several tax obligations. Employers contribute 21.5% of employee salaries to the social security system (INSS) and withhold 7% from employee wages for their social security contribution. You must also withhold income tax based on Nicaragua’s progressive rates (0-30%) and remit it to the tax authority. If you establish a local entity, you’ll also be subject to 30% corporate income tax and 15% VAT on goods and services. An EOR handles all these obligations on your behalf.

What are the benefits of hiring in Nicaragua vs other Latin American countries?

Hiring in Nicaragua offers several advantages over other Latin American countries. Nicaragua has some of the most competitive labor costs in the region while maintaining a growing skilled workforce. The GMT-6 time zone provides perfect alignment with U.S. Central time, enabling real-time collaboration. The widespread use of U.S. dollars in business transactions simplifies financial management. Nicaragua’s cultural compatibility with North American business practices and strong work ethic make team integration smoother. Additionally, the country’s improving digital infrastructure in urban centers supports remote work effectively.

Conclusion: Ready to Hire in Nicaragua?

Nicaragua offers an affordable, skilled workforce for companies looking to expand in Latin America. With its competitive labor costs, growing professional talent, and strategic time zone alignment, Nicaragua is well-suited for remote teams.

Whether you choose to hire in Nicaragua through contractors, partnering with an EOR, or setting up a local entity, this guide provides the tools you need to navigate Nicaragua’s labor market efficiently and compliantly. Start your journey to hire in Nicaragua today and unlock access to one of Latin America’s most promising talent markets.

How Can We Help You?

Whether you’re hiring your first role in Colombia or scaling an entire team, we support U.S. companies at every stage of the hiring journey:

- Remote Talent Recruitment – End-to-end recruiting for remote hires in Colombia, including market benchmarking, vetting, and candidate selection.

- In-Country Recruitment – Local, country-specific recruitment for companies building teams directly in Colombia.

- Recruitment as a Service (RaaS) – An embedded recruiting model where our team operates as an extension of yours to support ongoing or multi-role hiring needs.

- Staff Augmentation – Dedicated nearshore talent that integrates directly into your workflows, allowing you to scale teams quickly and predictably.

Ready to get started?

Tell us what roles you’re hiring for, and we’ll help you understand market availability, salary ranges, and the best hiring model for your team.