Managing payroll for international employees es is a whole different ball game. It’s not just about paying salaries; it’s about correctly handling all the taxes, benefits, and deductions for employees who live and work under completely different sets of rules. You’re constantly juggling each nation’s unique labor laws, tax codes, and currency regulations to make sure everyone gets paid accurately and on time, without breaking any laws.

Decoding Global Payroll Complexity

Paying your global team is far more complex than just wiring money overseas. Think of it like conducting an orchestra where every musician is playing from a different sheet of music. What sounds perfectly in tune in the United States could be a discordant mess in Brazil or Germany. A one-size-fits-all approach is a recipe for disaster.

To succeed with a distributed workforce, you have to break out of a domestic mindset. Every country you hire in adds a fresh layer of complexity, demanding a real understanding of local rules. Getting this wrong isn’t just inefficient; it opens your business up to steep fines, legal headaches, and can seriously damage trust with your team.

The sheer scale of this challenge is why the global payroll market is expected to grow to an estimated USD 13.13 billion by 2033. Many large companies are already juggling payroll in as many as 25 different countries, which just goes to show how critical solid solutions have become.

Why a Single Approach Fails

A payroll system designed for one country is built on a single, predictable set of rules. An international framework, on the other hand, has to juggle wildly different variables. This is why a strategy that is centrally managed but locally executed is absolutely essential.

Here are just a few of the things that change from one border to the next:

- Tax Withholding: Income tax rates and filing rules can be worlds apart. What’s a simple calculation in one country is a multi-tiered system in another.

- Social Security: Every country has its own version of social security for things like pensions, healthcare, and unemployment. The costs and contribution structures vary dramatically.

- Statutory Benefits: Things we take for granted, like paid time off, parental leave, and sick days, are not universal. The legal requirements can be completely different.

- Currency and Banking: You’re not just dealing with exchange rates. Each country has its own banking system and regulations that dictate how payments can be made.

For instance, a performance bonus might be taxed at a simple flat rate in one country, but in the country next door, it could be treated as regular income and taxed at a much higher marginal rate. This is precisely why a localized approach isn’t just a “nice-to-have”—it’s the only way to build a sustainable foundation for global growth.

Key Hurdles in International Payroll at a Glance

Navigating the world of global payroll means confronting a variety of distinct challenges. The table below breaks down the most common hurdles you’ll encounter.

| Challenge Area | Description | Example Impact |

|---|---|---|

| Legal & Regulatory | Each country has its own labor laws, tax codes, and statutory requirements for pay and benefits. | Miscalculating social security in France can lead to fines, while failing to provide mandatory leave in Japan can result in legal action. |

| Cultural Nuances | Compensation expectations, holiday schedules, and the concept of a “13th-month” salary vary significantly. | Offering a standard US benefits package in a country with robust public healthcare might be seen as redundant and unappealing. |

| Currency & Banking | Managing multiple currencies, volatile exchange rates, and different banking systems complicates payments. | Fluctuating exchange rates can cause an employee’s take-home pay to vary month-to-month, creating financial instability. |

| Data Security | Protecting sensitive employee data across different jurisdictions with varying privacy laws (like GDPR) is critical. | A data breach in one country could violate international privacy laws, resulting in massive penalties and loss of trust. |

| Technology & Systems | Integrating disparate local payroll systems with a central HRIS is a major technical challenge. | Without a unified system, generating a simple global headcount or labor cost report can become a manual, error-prone nightmare. |

Each of these hurdles highlights why a well-thought-out, expert-led approach is not just a preference but a necessity for any company looking to operate effectively on a global scale.

Navigating the Maze of Global Compliance

Jumping into global payroll is like stepping into a labyrinth of legal and financial rules. Every country has its own way of doing things, and assuming what works at home will fly abroad is a surefire way to rack up costly penalties and create operational chaos. This isn’t just about wiring money; it’s about navigating a dense, country-specific web of local laws.

Think of it this way: each country’s compliance framework is like a unique electrical grid. A plug built for the US won’t fit a socket in Germany, and if you try to force it, you risk a system-wide meltdown. In the same vein, applying a single, one-size-fits-all payroll policy across different borders will inevitably short-circuit your operations.

Successfully managing payroll for international employees means you need a rock-solid understanding of several critical compliance areas. These aren’t just administrative checkboxes—they are fundamental legal duties that, if you get them wrong, can put your entire business at serious risk.

Core Compliance Pillars You Cannot Ignore

At its core, global compliance stands on three non-negotiable pillars: tax withholding, social security contributions, and local labor laws. Each one is location-specific, forming the bedrock of any lawful payroll process.

- 1. Tax Withholding and Reporting: Every country has its own approach to income tax. You’ll see huge variations, from the progressive tax brackets in Canada to the tax-free environment for personal income in the UAE. As the employer, you are legally on the hook for accurately calculating, withholding, and remitting these taxes to the right government agencies.

- 2. Social Security Contributions: These are the mandatory payments that fund a country’s public welfare programs, like pensions, healthcare, and unemployment benefits. In Germany, for instance, both the employer and the employee chip in significant amounts to a comprehensive social insurance system. Failing to pay the right amount can lead to fines and, just as importantly, deny your employees the critical benefits they’re entitled to.

- 3. Local Labor and Employment Laws: These laws are the rulebook for the entire employment relationship. They dictate everything from minimum wage and working hours to overtime pay and termination procedures. What’s considered a perfectly valid reason for dismissal in one country could be completely illegal in another. Understanding these rules is crucial for avoiding wrongful termination lawsuits and other legal headaches. Labor laws can be especially detailed in certain regions, so it pays to do your homework if you plan to hire in Brazil or other Latin American countries.

Key Takeaway: Compliance isn’t a suggestion; it’s a legal mandate. Each new country on your payroll map introduces a new set of rules that must be meticulously followed. Ignoring these local specifics is one of the quickest ways to derail an international expansion strategy.

Deeper Risks Beyond the Paycheck

Beyond the core pillars of payroll, going global introduces broader compliance risks that can have serious financial and legal fallout for your entire organization.

One of the biggest hidden dangers is Permanent Establishment (PE) risk. This is a tax concept where simply hiring employees in a country—without setting up a formal legal entity—can inadvertently make your entire company liable for corporate taxes there. In essence, your business activities could be seen as substantial enough to create a “permanent” presence, making your global profits taxable in that country.

Another huge area is data privacy. When you handle the personal information of your global team, you’re bound by strict data protection laws like Europe’s General Data Protection Regulation (GDPR). Getting this wrong can lead to massive fines—up to 4% of your annual global turnover.

These challenges are a big part of why standardizing global payroll is so tough. A recent PayrollOrg survey found that very few companies have managed to build consistency across their international operations, with many admitting their processes are subpar. The United States, Canada, and France often come up as the most difficult countries for payroll due to their complex tax codes and strict labor laws. This complexity exists against a global “jobs gap” of over 400 million people, highlighting the massive workforce whose pay and compliance rely on these intricate systems.

On top of payroll regulations, companies must also juggle the complexities of immigration for their international team. Tools like specialized immigration case management software can be a lifesaver for tracking visas and work permits, adding another critical layer of compliance to manage. At the end of the day, a proactive and well-informed approach is the only way to operate with confidence and sidestep these costly mistakes.

Choosing Your Global Payroll Model

When it comes to payroll for international employees, there’s no silver bullet. The “best” solution is the one that actually fits your company’s size, budget, risk appetite, and where you see yourself growing in the long run. This isn’t just an administrative choice; it’s a strategic one that dictates how fast you can scale and how much risk you’re willing to take on.

Think of it like picking a vehicle for a road trip. A solo traveler on a shoestring budget might grab a motorcycle—it’s fast, nimble, and cheap to run. But a family moving across the country needs a big moving truck. It’s slower and more expensive, but it’s the only thing with the capacity to get the job done. Your global payroll setup works the same way; it has to match your specific business journey.

Let’s walk through the three main models you’ll encounter. We’ll unpack the good and the bad of each to help you find the right fit.

Model 1: The DIY Approach with a Local Entity

The most traditional route is to roll up your sleeves and build your own legal entity in every country you hire in. This means setting up a full-blown subsidiary or branch office, registering with all the local tax authorities, and running payroll yourself with an in-house team or a local accounting firm.

This approach gives you maximum control. Every single aspect of the employment relationship, from shaping the office culture to choosing the benefits package, is in your hands. For a massive company with long-term plans to build a major presence—say, a new regional headquarters with 100+ employees—this heavy investment often makes perfect sense.

But the trade-offs are steep.

- High Cost: Setting up a legal entity is a serious financial commitment, packed with legal fees, registration costs, and continuous administrative overhead.

- Slow Time-to-Market: The process can easily drag on for months, putting you on the sidelines while top talent gets scooped up by competitors.

- Full Compliance Burden: Your company shoulders 100% of the legal and compliance risk. Everything from payroll math to labor law disputes lands squarely on your plate.

This is the moving truck of global payroll—powerful and all-encompassing, but slow, expensive, and it takes a lot of skill to operate without running into trouble.

Model 2: The Agile Path with an Employer of Record

An Employer of Record (EOR) is the modern, flexible answer to global hiring. An EOR basically becomes the legal employer for your team in a specific country, shouldering all the official HR and payroll compliance duties for you. You find the talent and manage their day-to-day work; the EOR handles all the backend legal and administrative headaches.

This model is built for speed. A startup that wants to hire a star developer in Portugal can get them onboarded in days, not months, without the pain and cost of setting up an entity. It’s perfect for testing the waters in a new market with very little risk or upfront cash.

An EOR acts as a compliance shield, insulating you from the complex and ever-changing laws of a foreign country. They manage payroll, taxes, and mandatory benefits, making sure you’re operating legally from day one. This frees you up to focus on what you do best—growing your business.

The main trade-off? You have less direct control over the formal employment structure, since your team is technically employed by a third party. For most small and mid-sized businesses hungry for fast, compliant growth, it’s a small price to pay. When you want to hire in Argentina, for example, an EOR can navigate the country’s notoriously complex labor laws on your behalf.

Model 3: The Centralized Hub with a Global Payroll Provider

The third option is to partner with a global payroll provider. This model is for companies that already have legal entities in several countries but are struggling to manage it all. A global payroll provider consolidates payroll data from all your different entities, standardizes the process, and handles payments through a single, central platform.

This isn’t a tool for entering a new market; it’s a tool for bringing order to the chaos once you’re already established globally. It helps unify reporting and makes payments more efficient, but it doesn’t solve the core problem of legal employment or HR compliance in countries where you don’t have an entity.

As you weigh your options, it’s also smart to understand the best ways to pay international contractors, as this can be a valuable part of your overall global workforce strategy. In the end, picking the right model is a foundational decision that will have a direct impact on your global expansion’s success.

Anatomy of an International Payroll Cycle

Alright, let’s move from the abstract to the concrete. What does it actually look like to pay your team across different countries, month after month? This isn’t just a high-level overview; it’s a step-by-step breakdown of the real-world international payroll cycle. Getting this process right means creating a workflow that’s reliable and efficient enough to standardize, yet flexible enough to adapt to local rules.

To make this real, let’s imagine your company just hired Ana, a fantastic software engineer based in Spain. Paying Ana isn’t as simple as wiring her some money. It’s a precise sequence of events where one small mistake can lead to delays, an unhappy new employee, or even a run-in with Spanish authorities. The whole process relies on getting things right from the very beginning.

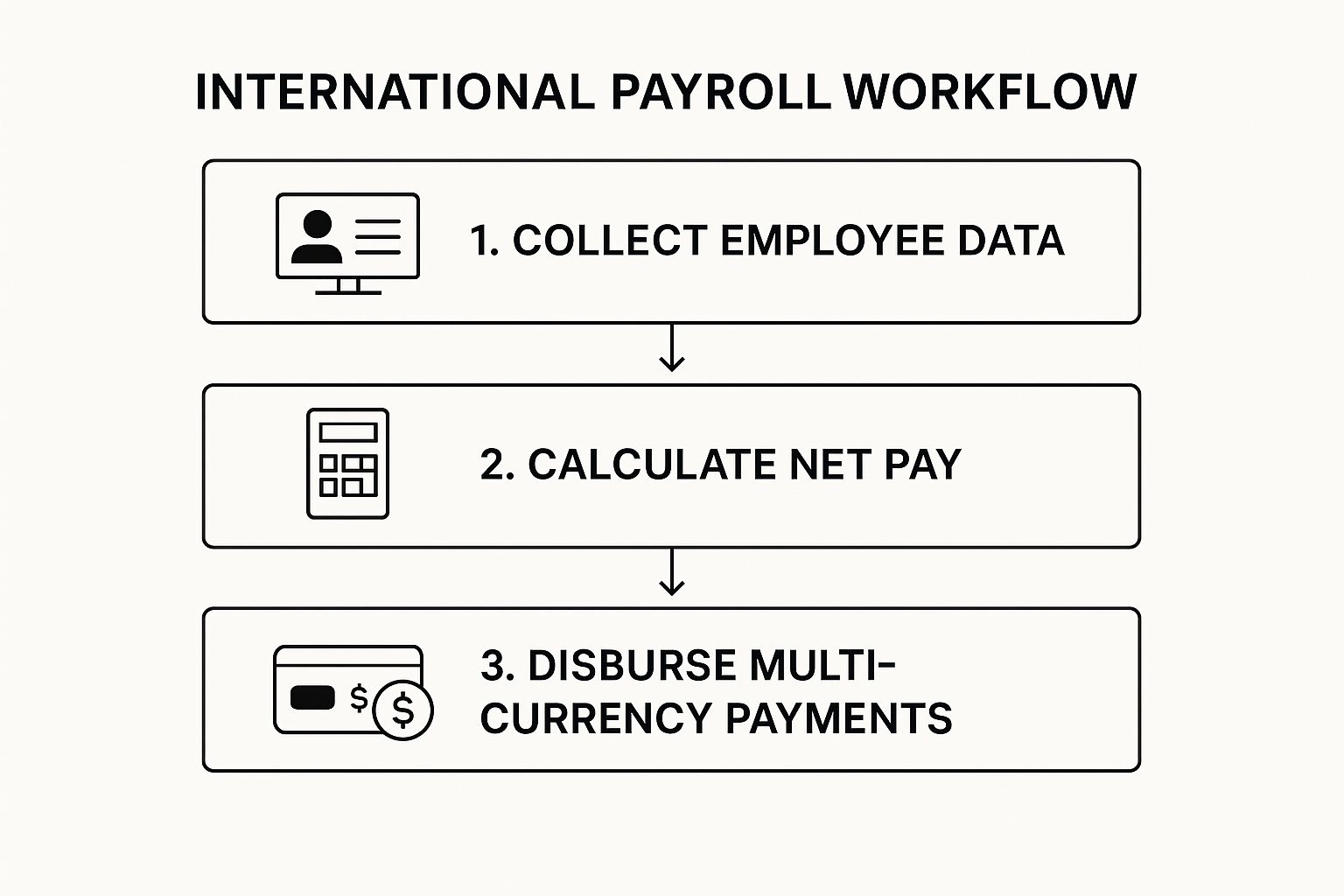

This infographic lays out the core steps for managing payroll for your international employees, from collecting their data to making the final payment.

As you can see, a successful payroll run is a chain reaction. Each step has to be done correctly to inform the next one.

Stage 1: Collecting and Validating Data

Every payroll cycle kicks off with data collection. Honestly, this is where most things go wrong. In fact, a staggering 80% of payroll errors trace back to bad data at the input stage. For Ana in Spain, this initial “gross-to-net” file needs to be flawless.

And we’re not just talking about her base salary. This file has to capture every variable that affects her pay for that specific period:

- New Hire Information: Her personal details, tax ID number (which is the NIF in Spain), bank account info, and social security number.

- Compensation Changes: Any pay raises, one-off bonuses, or commissions she might have earned.

- Time and Attendance: The hours she worked, any overtime, and approved paid time off.

Once you have all this information, it has to be checked against local Spanish regulations. Is her salary above the minimum wage for her professional category? Are her overtime hours calculated according to Spanish labor law? Think of this validation step as a firewall—it’s your best defense against expensive mistakes later on.

A Common Failure Point: Something as simple as an extra zero on a bonus or a typo in a bank account number can throw the entire process off track. A solid validation system, whether you do it by hand or with software, is absolutely non-negotiable.

Stage 2: The Calculation and Funding Engine

With clean, validated data, you can move on to the actual calculations. This is the part where Ana’s gross pay is transformed into her net, or take-home, pay. To do this, you have to subtract all the mandatory deductions required by Spanish law.

These deductions aren’t optional, and they’re very specific:

- IRPF (Personal Income Tax): This is withheld based on a progressive scale that depends on her salary.

- Social Security Contributions: These are payments for pensions, unemployment benefits, and professional training funds.

- Other Deductions: This could include any other required withholdings or contributions to things like private health plans.

At the same time, you have to tackle currency conversion and funding. You’ll need to convert your company’s currency, say USD, into Euros to pay Ana. This opens you up to exchange rate risk. You also have to make sure your bank account has enough Euros to cover not just her net pay, but also the employer’s share of social security contributions. And it all has to be there before the payment deadline. Timing is everything here.

Stage 3: Disbursement and Reporting

The final stage is all about execution and wrapping things up. First, the net payment is sent to Ana’s bank account. On that same day, you need to send the taxes and social security contributions you withheld to the correct Spanish government agencies.

But you’re not done yet. You also have to generate a compliant payslip for Ana. In Spain, this document has a strict legal format and must clearly list all her earnings and deductions. It gives her a transparent record of her pay, which is crucial for building trust.

Finally, you close the loop with statutory reporting. This means submitting payroll-related reports to the government, usually on a monthly or quarterly basis, to confirm that you’ve met all your legal obligations as an employer. This officially ends the payroll cycle and gets you ready to do it all over again next month.

Best Practices for Seamless Global Payroll

Running payroll for international employees is one thing; doing it well is another. Once you have the basic process down, a few key practices can make all the difference. They help you sidestep common risks, boost efficiency, and keep your global team happy and engaged.

Think of it like this: anyone can learn the basic rules of the road, but an experienced driver anticipates traffic, knows the shortcuts, and keeps their car in top shape. These best practices are what take your payroll function from simply being compliant to being a strategic asset.

Create a Unified Global Payroll Calendar

One of the simplest yet most powerful things you can do is create a single payroll calendar for every country you operate in. This master schedule becomes your command center, clearly marking every critical date for every payroll cycle, everywhere.

Without it, you’re constantly scrambling. Is the cutoff for the team in Mexico the 15th or the 20th? Does that UK bank holiday mean we need to shift the pay date? A central calendar gets rid of the guesswork.

Make sure it includes:

- Deadlines for collecting new hire info, terminations, and bonus data.

- Cutoffs for internal teams to review and approve the payroll register.

- Dates for wiring funds to your local bank accounts.

- The official pay dates for employees in each country.

- Deadlines for filing taxes and paying social security contributions.

This calendar isn’t just a schedule; it’s your single source of truth. It creates a predictable rhythm that prevents those last-minute fire drills and ensures you never miss a critical deadline.

A global payroll calendar is more than a schedule; it’s a communication tool. It provides transparency for everyone involved, from the central HR team to local managers and employees, setting clear expectations for the entire process.

Establish a Central System of Record

Data chaos is the biggest threat to accurate international payroll. When employee information is scattered across a dozen spreadsheets, local HR folders, and random emails, mistakes aren’t just possible—they’re guaranteed. That’s why having a central system of record isn’t just a nice-to-have; it’s essential.

This system, which is usually a Human Resource Information System (HRIS), acts as the one true source for all employee data. Any time something changes—a pay raise, a new address, updated bank details—it happens in one place.

This simple discipline ensures every payroll run pulls from the exact same clean, current data. It drastically cuts down on the errors that almost always stem from manual data entry and conflicting records. It’s the very foundation of reliable payroll for international employees.

Proactively Manage Currency Fluctuations

Paying people in their local currency is non-negotiable for a good employee experience, but it opens your business up to currency risk. Exchange rates can swing wildly between the day you calculate payroll and the day you send the money, which can throw your budget for a loop.

Don’t just cross your fingers and hope for the best. You can—and should—manage this volatility. Many financial partners and global payroll platforms let you lock in exchange rates ahead of time. This gives you certainty. You’ll know exactly how much you need to fund payroll in your home currency, with no unpleasant surprises. A small fluctuation might not seem like much, but across a large team and an entire year, those costs can really add up.

Foster Clear Communication About Pay

Finally, never forget the people behind the numbers. A payslip can be incredibly confusing, especially when it’s filled with unfamiliar deductions and foreign tax codes. When people don’t understand their pay, it can quickly breed anxiety and mistrust.

Make clear communication a core part of your process. Provide simple, easy-to-understand explanations for every item on the payslip. It’s a great idea to create a short guide for each country that breaks down what each line means. A quick heads-up about pay dates, holidays, or upcoming bonuses also goes a long way. This kind of transparency builds enormous trust and shows your international team that you’re handling their compensation with care and professionalism.

Your Top Global Payroll Questions, Answered

As you start hiring across borders, you’ll find the same questions about payroll for international employees pop up again and again. I’ve heard them all. This section is designed to give you clear, practical answers to the most common hurdles you’re likely to face. We’ll get straight to the point on everything from currency risk to the different ways you can structure your payroll.

What’s the Difference Between an EOR and a Global Payroll Provider?

This is easily the most common point of confusion I see, and getting it right is crucial. The distinction is pretty simple when you think about it this way: are you looking for someone to build the house, or just wire the electricity?

An Employer of Record (EOR) is the general contractor building the entire house for you. It legally hires people on your behalf in a country where you don’t have a registered business. The EOR puts the employee on its own local payroll and takes on all the legal and HR burdens that come with it.

This means the EOR is responsible for:

- Running payroll and withholding the correct taxes.

- Administering all mandatory benefits, like health insurance or pension contributions.

- Ensuring you’re 100% compliant with local labor laws.

- Handling employment contracts, terminations, and everything in between.

Basically, an EOR is your go-to solution when you want to hire talent in a new country fast, without the headache and massive expense of setting up a foreign subsidiary.

A global payroll provider, on the other hand, is your specialized electrician. This service is for companies that already have legal entities in their various countries of operation. The provider doesn’t become the legal employer. Instead, it centralizes and processes payroll across all your different locations. They bring order to your existing global footprint by simplifying payments and giving you a single source of truth for reporting. You, however, remain the legal employer and carry all the responsibility for HR and compliance.

The bottom line: An EOR is your all-in-one solution for both legal employment and payroll in a new country. A global payroll provider is a tool for consolidating payments across your established international entities.

How Should I Handle Currency Fluctuations When Paying My Team?

Dealing with volatile currency exchange rates is a reality of international payroll. You have two ways to approach this, but one is clearly better for everyone involved.

The standard—and best—approach is to pay employees in their local currency. This is the right thing to do for your team because it protects them from currency risk. They know exactly what they’re taking home each month. Your company absorbs the risk from rate fluctuations, but modern payment platforms help you manage this by letting you lock in exchange rates, giving you budget predictability.

The alternative, which I almost never recommend, is paying everyone in a single currency like the US dollar. This might seem simpler for you, but it pushes all the currency risk onto your employees. Their actual take-home pay could swing wildly from month to month, creating financial stress and resentment. Even worse, paying in a foreign currency is often illegal, as many countries mandate that wages be paid in the local currency.

What Are the Biggest Compliance Risks in Global Payroll?

When it comes to international payroll, the most serious risks all come down to one thing: failing to follow local rules. These aren’t just minor administrative mistakes; they can trigger severe financial and legal penalties that can seriously damage your business.

Top 5 Compliance Risks

- Incorrect Tax & Social Security Withholding: This is the number one mistake. Every country has its own maze of rules for deductions. Get it wrong, and you’re looking at hefty fines from tax authorities and a mess of liabilities for both you and your employee.

- Worker Misclassification: It’s tempting to label someone an “independent contractor” to avoid payroll taxes and benefits. But if the authorities decide that person is actually a “disguised employee,” you can be hit with enormous back taxes, fines, and legal battles.

- Permanent Establishment Risk: This is a huge tax trap that many companies fall into blindly. If you have employees generating revenue in a country without a local legal entity, you can accidentally create a “permanent establishment.” This could make your company’s global profits subject to corporate taxes in that country.

- Data Privacy Violations: You’re handling incredibly sensitive employee information. If you’re not compliant with strict data privacy laws like GDPR in Europe, you risk staggering fines that can run into the millions.

- Ignoring Local Labor Laws: Things like mandatory benefits, how overtime is calculated, proper termination processes, or required leave can’t be overlooked. A slip-up here can lead to expensive lawsuits and tarnish your reputation as an employer.

Each of these risks shows why having a detailed, country-specific strategy for payroll for international employees isn’t just a good idea—it’s essential for survival. A small oversight can easily snowball into a major crisis, which is why getting expert guidance is so valuable as you grow.

Ready to hire top talent across Latin America without the compliance headaches? Nearshore Business Solutions specializes in helping US companies build remote teams by managing all the complexities of local payroll, benefits, and legal compliance.