Understanding The Explosive Fintech Recruitment Revolution

The fintech talent landscape presents both exciting opportunities and significant challenges. Traditional financial services recruitment methods are often insufficient for the unique demands of this rapidly changing sector. This requires a fundamental shift in how companies approach finding the right people. Understanding the specific needs and dynamics of the fintech industry is paramount for attracting top-tier professionals.

The Changing Face Of Fintech Talent

Rapid industry growth has significantly altered candidate expectations. While compensation remains a key factor, it’s no longer the sole driver for financial professionals. Factors like company culture, work-life balance, and opportunities for professional development are increasingly important. Additionally, the skills required for fintech roles are constantly evolving. A deep understanding of technology is now just as crucial as financial acumen.

The Impact Of Growth On Skill Requirements

The explosive growth of the fintech industry isn’t just creating a higher volume of jobs; it’s transforming the very nature of the work itself. From January to April 2024, the UK FinTech sector saw a 61% year-on-year increase in job vacancies. Demand was particularly high for technology roles such as software development and engineering. This surge highlights the ongoing digital transformation of finance and the constant emergence of new financial technologies. For a more detailed analysis, take a look at these Fintech Leadership Hiring Trends.

Adapting Recruitment Strategies For Success

Adapting to these shifts is essential for creating effective recruitment strategies. This involves a thorough understanding of the current talent market and its specific nuances within fintech. A generic, one-size-fits-all approach simply won’t be effective in this competitive environment.

Targeted strategies focused on specific candidate segments are crucial for securing the best talent. This includes crafting a compelling employer brand and developing interview processes that accurately assess both technical skills and cultural fit. Ultimately, successful fintech recruitment hinges on recognizing these dynamics and responding proactively.

Navigating the Fierce Competition for Fintech Talent

The fintech industry is booming, and with this incredible growth comes intense competition for skilled professionals. It’s not simply about offering the highest salaries; it’s about understanding the complexities of the talent market and developing strategies that truly connect with today’s fintech candidates. As of 2025, over 29,955 fintech startups operate globally, all competing for the same limited pool of talent. These companies have raised billions in funding, highlighting the vast potential of the sector while simultaneously escalating the battle for skilled individuals. For a deeper dive into the state of the industry, check out these fintech statistics.

Understanding the Drivers of Talent Scarcity

Several key factors contribute to the scarcity of qualified fintech professionals. The rapid pace of technological advancement creates a constant demand for new skills. This means even seasoned professionals must continuously upskill to stay competitive. Furthermore, the demand for specialized skills, such as blockchain development or AI expertise, often outpaces the available supply. This high demand creates a highly competitive market, requiring companies to be proactive and strategic in their recruitment efforts.

Benchmarking Against Market Leaders

To compete effectively, fintech companies need a clear understanding of their position in the talent market. Benchmarking against industry leaders provides invaluable insights. This involves analyzing competitor compensation packages, benefits, and company culture. It also requires understanding how potential candidates perceive your company’s brand and reputation.

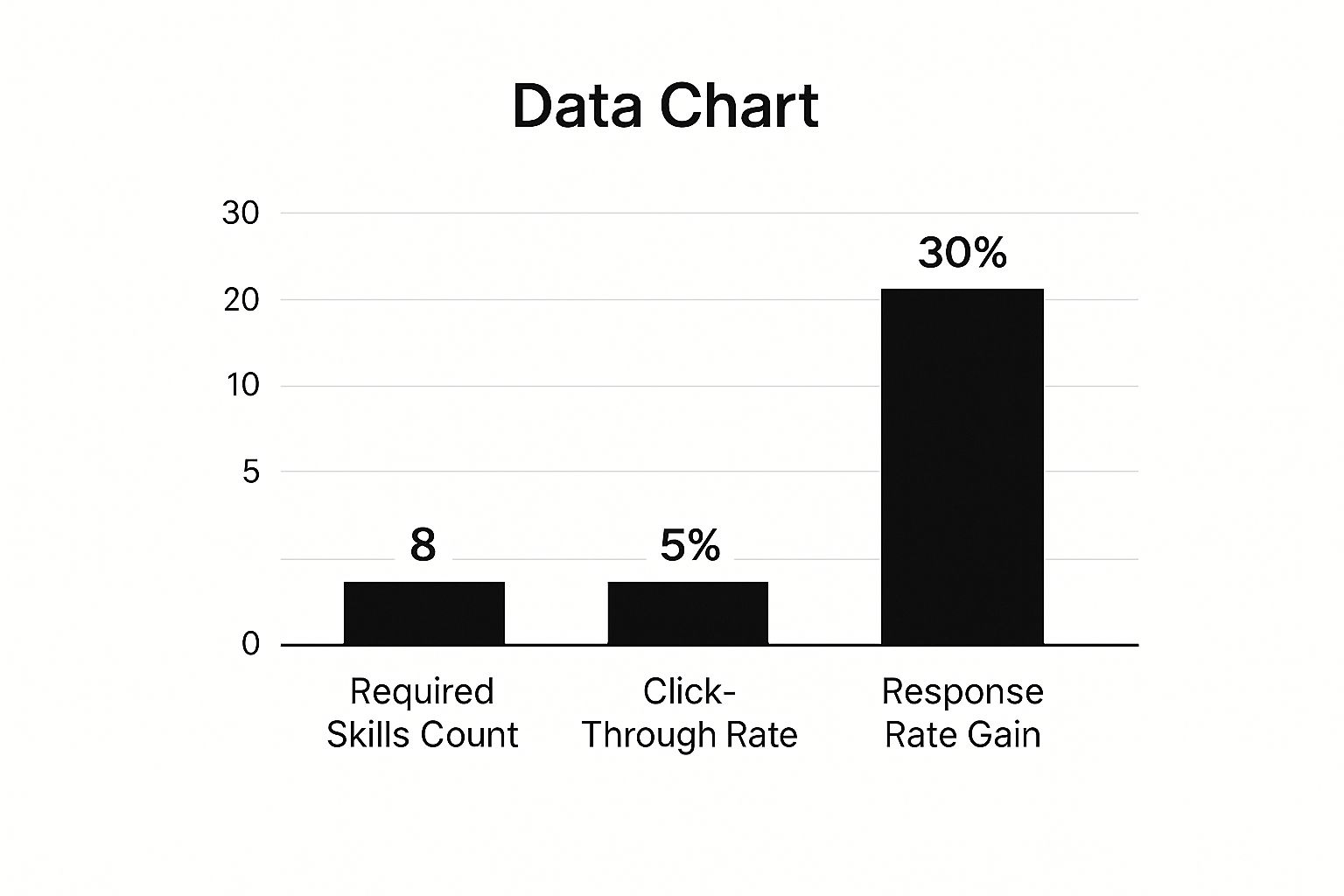

The infographic above visualizes some key recruitment metrics. The average number of required skills for a fintech job is 8, the typical click-through rate on job postings is 5%, and the potential increase in response rate with improved recruitment strategies is 30%. This data emphasizes the need for targeted job postings and optimized recruitment strategies to boost candidate engagement. Simply posting open positions is insufficient; companies need to actively engage with potential candidates and demonstrate the unique value they offer.

To better understand the current competitive landscape, let’s take a look at the following table. It breaks down key recruitment metrics across different fintech market segments.

Fintech Recruitment Competition Analysis

| Market Segment | Number of Companies | Average Funding | Talent Competition Level | Typical Time to Hire |

|---|---|---|---|---|

| Payments | High | High | Very High | Long |

| Lending | Medium | Medium | High | Medium |

| Insurance (Insurtech) | Medium | Medium | Medium | Medium |

| Investment Management (Wealthtech) | Low | High | Medium | Short |

| Blockchain & Cryptocurrency | High | High | Very High | Long |

This table highlights the significant variation in competition levels and time-to-hire across different fintech segments. As you can see, areas like Payments and Blockchain/Cryptocurrency face the fiercest competition for talent, leading to longer hiring processes.

Practical Approaches for Standing Out

Differentiating from the competition demands a multifaceted strategy. This includes several crucial components:

- Developing a strong employer brand: Showcase your company culture, values, and career development opportunities.

- Crafting compelling job descriptions: Don’t just list requirements; highlight the exciting aspects of the role and its impact on the company.

- Offering competitive compensation and benefits: Consider not just salary, but also equity, bonuses, and perks such as flexible work arrangements.

- Building a robust recruitment process: Streamline the application process, provide timely feedback to candidates, and create a positive interview experience.

By understanding the dynamics of the competitive landscape and implementing these strategies, fintech companies can attract and retain the top-tier talent necessary for success.

Decoding What Modern Fintech Candidates Really Want

Today’s fintech professionals are looking for more than just a high salary. While compensation is still a factor, career decisions are now influenced by a wider range of considerations. This requires a more nuanced understanding of what motivates candidates if companies want to successfully recruit within the competitive fintech industry. For example, recent hiring efforts show that businesses are having difficulties attracting talent.

Data from the 2025 Selby Jennings Talent Report suggests that non-salary factors, like work-life balance, remote work options, and career development, are increasingly important for securing top talent. To explore this topic further, review the full research.

Beyond the Paycheck: Understanding Key Motivators

Modern fintech candidates desire a well-rounded work experience. This includes a significant focus on work-life balance, opportunities for continuous learning, and a company culture that reflects their values. Simply offering a competitive salary is no longer enough to attract and retain top performers.

Companies need to create appealing employee value propositions that address these wider needs. Attracting talent is about more than just compensation; it’s about offering a fulfilling and supportive work environment.

The Role of Remote Work and Flexibility

The pandemic dramatically increased the prevalence of remote work, a trend that continues to grow, especially in fintech. Many candidates now prioritize remote work options and flexible schedules, which allow them to balance personal commitments with their professional responsibilities.

Offering remote work possibilities can significantly broaden a company’s access to talent and attract candidates who value work-life integration. This flexibility can be a key differentiator in attracting and retaining top-tier employees.

Career Development and Growth Opportunities

Fintech is a fast-paced industry, and professionals are eager to keep their skills up-to-date. This makes opportunities for professional development and career advancement highly desirable. Providing access to training programs, mentorship, and clear career paths can be a powerful incentive.

This benefits both the employee and the company, enhancing the organization’s overall expertise and competitiveness in the market. Investing in employee growth is an investment in the future of the company.

Equity and Ownership: Aligning Incentives

Equity packages can be a significant draw in the fintech industry, particularly for startups and rapidly expanding companies. Offering equity provides employees with a sense of ownership and aligns their interests with the company’s success.

This can be especially appealing to individuals looking for long-term growth and a stake in the company’s future. Equity also improves employee retention rates and serves as a strong recruitment tool. It’s a way to demonstrate a shared commitment to success.

Building Sourcing Strategies That Actually Find Top Talent

The best fintech talent isn’t actively searching job boards. They’re already employed, often at competing companies. This requires a strategic sourcing approach that goes beyond traditional methods, focusing on identifying and engaging passive candidates. Savvy hiring managers understand the importance of building relationships with potential hires long before a position opens.

Identifying Passive Candidates

Passive candidates are a significant pool of highly skilled professionals not actively seeking new jobs. Engaging them requires a proactive, targeted approach, similar to networking. It’s about building relationships that could lead to future opportunities.

- Specialized Fintech Communities: Online forums, industry events, and professional groups are excellent places to connect with passive talent.

- Social Media Platforms: LinkedIn is crucial for fintech recruitment. Use it to find and connect with individuals possessing the skills and experience your company needs.

- Data-Driven Sourcing: Leverage tools and platforms to search for candidates based on specific skills, experience, and even competitor affiliations.

Attending a fintech conference, for example, allows you to organically meet potential candidates and forge valuable connections. Using boolean search strings on LinkedIn helps pinpoint individuals with specific skills relevant to your company’s needs.

Leveraging Fintech Networks

A strong network within the fintech industry is invaluable for sourcing talent. This means actively participating in industry events, nurturing professional relationships, and utilizing your existing team’s connections. Proactive networking builds a pipeline of potential candidates already familiar with your company.

- Internal Referral Programs: Encourage employee referrals. This can be a highly effective way to find top talent. Offer incentives to motivate employees and generate excitement around referrals.

- Industry Partnerships: Collaborate with other fintech companies, universities, and organizations to expand your reach and access a wider talent pool. Partnerships can unlock access to talent not typically found through traditional methods.

- Alumni Networks: Connect with alumni groups from universities known for strong fintech programs. This provides access to a skilled and motivated pool of candidates looking to advance their careers.

Building these relationships takes time. Consistent engagement and genuine relationship-building are essential. This creates a pool of candidates already familiar with your company and its work. You might be interested in: How to master nearshore IT staffing.

Engaging Potential Candidates

Once you’ve identified potential candidates, engage them in a way that generates genuine interest. This goes beyond sending a generic job description. It requires personalized outreach and a clear understanding of their career goals.

- Personalized Messaging: Craft messages demonstrating a genuine interest in the candidate’s skills and experience. Highlight aspects of your company culture and the specific role that align with their aspirations. Avoid generic templates.

- Value-Driven Communication: Focus on your value proposition. Emphasize career growth opportunities, engaging projects, and a positive work environment.

- Relationship Building: Engage in conversations and build rapport before discussing specific job opportunities. This fosters trust and mutual understanding.

This approach creates a positive candidate experience and positions your company as an employer of choice. By showing genuine interest in their career goals, you’re more likely to attract top talent who are a good fit for your organization. Building these sourcing strategies requires ongoing commitment and consistent effort, but the payoff in talent acquisition is significant.

Creating Job Descriptions and Employer Brand That Converts

Your job postings and employer brand are often the first point of contact a potential candidate has with your company. In the competitive fintech market, this first impression is critical. Many fintech job descriptions, however, fail to grab attention and truly showcase the opportunity. This results in companies missing out on top-tier talent. This section explores how to create engaging job descriptions and cultivate an employer brand that resonates with fintech professionals.

Crafting Compelling Job Descriptions

A well-crafted job description is more than just a list of prerequisites. It’s a powerful marketing tool designed to attract and engage potential candidates. It needs to clearly articulate the role’s responsibilities while emphasizing the positive aspects of working at your company.

- Focus on the Impact: Detail how the role contributes to the company’s overarching mission and objectives. Underscore the potential for fulfilling work and career progression.

- Showcase Your Tech Stack: Explicitly state the technologies employed in the role. This draws in candidates enthusiastic about specific technologies and ensures a good fit skill-wise. Transparency about your tech stack saves time for everyone involved.

- Highlight Company Culture: Incorporate aspects of your company culture into the description. This helps candidates gain insight into the work environment and assess whether it aligns with their own values.

For example, instead of stating “Experience with Java required,” try “Leverage your Java skills to build innovative solutions impacting millions of users.” This approach generates more excitement and demonstrates the meaningful impact of the work.

Building an Authentic Employer Brand

Your employer brand is the overall impression of your company as an employer, both internally among employees and externally to potential hires. It’s how you set yourself apart in the talent market and appeal to candidates who share your company’s values. This is especially important when recruiting in the fintech sector.

- Showcase Growth Opportunities: Fintech professionals are often motivated by career advancement. Emphasize the potential for learning, development, and upward mobility within your company.

- Emphasize Company Culture: Authentically showcase your company culture using employee testimonials, blog posts, and social media. This offers potential candidates a genuine look at your company’s work environment.

- Communicate Your Value Proposition: What makes your company a desirable and unique place to work? Clearly communicate the advantages and opportunities beyond compensation.

This might include highlighting your commitment to innovation, social impact, or employee well-being.

Consistent Messaging Across All Touchpoints

Consistency in your employer brand messaging across all candidate touchpoints is key. This includes your company website, social media presence, and job postings. Consistent messaging builds trust and reinforces your company’s values throughout the hiring process. Conversely, inconsistency can lead to confusion and even discourage candidates from applying.

This involves using a consistent tone of voice, highlighting your company culture, and communicating your unique value proposition across all recruitment materials. By crafting compelling job descriptions and building a solid employer brand, you can attract top-quality candidates genuinely excited to join your fintech company.

Designing Interview Processes That Win Top Candidates

A slow or poorly designed interview process can seriously hinder fintech companies, especially when vying for in-demand talent. Top candidates often have multiple offers, making a streamlined and efficient process essential. This means structuring interviews to thoroughly assess technical skills, cultural fit, and growth potential, all while providing a positive candidate experience.

Structuring Interviews for Success

Creating an effective interview process involves more than just asking the right questions. It requires thoughtful planning and execution to create a cohesive and engaging experience.

- Technical Assessments: Use practical coding challenges, case studies, or simulations directly related to the role. These assessments offer a concrete measure of a candidate’s technical abilities and problem-solving skills.

- Behavioral Interviews: Include behavioral questions to understand how candidates have handled past situations and whether their experiences align with your company values. Asking about a time they overcame a challenge, for example, can reveal their problem-solving approach and resilience.

- Final-Round Evaluations: Design final-round interviews to evaluate not just technical skills but also cultural fit and long-term potential. This could involve meetings with senior leadership or team exercises.

This multifaceted approach ensures a thorough evaluation of a candidate’s qualifications and suitability. For further insights on remote hiring, check out this resource: How to master hiring remote developers.

Maintaining Candidate Engagement

Keeping candidates engaged throughout the process is critical in a competitive market. A long, drawn-out process, or worse, a lack of communication, can lead candidates to lose interest. This is especially true in the fast-paced world of fintech recruiting.

- Timely Communication: Provide prompt feedback and keep candidates updated on their progress. This shows respect for their time and keeps them invested in the opportunity.

- Transparency: Clearly outlining the interview stages and expectations helps candidates prepare and reduces anxiety. Transparency builds trust and contributes to a positive experience.

- Personalized Interaction: Personalize the interview by tailoring questions and discussions to each candidate’s background and career goals. This strengthens the connection and demonstrates genuine interest.

Handling Competitive Offer Situations

Top candidates often receive multiple offers in today’s competitive fintech market. This requires a proactive and strategic approach to secure the best talent. Speed and efficiency are key.

- Expedite the Process: Streamline the interview process to minimize delays and be prepared to make decisions quickly.

- Highlight Your Value Proposition: Clearly communicate the unique advantages of working at your company, such as career development opportunities, company culture, and compensation.

- Negotiate Effectively: Be ready to negotiate salary and benefits to attract and secure top-tier candidates.

Reflecting Company Values in the Interview Experience

The interview process itself should reflect your company’s values and culture. This provides candidates with valuable insight into the work environment and helps them determine whether they would be a good fit.

- Culture-Focused Questions: Include questions that explore a candidate’s values and alignment with your company culture.

- Team Interaction: Allow candidates to interact with potential team members to get a sense of team dynamics and work style.

- Feedback Mechanisms: Encourage candidates to provide feedback on the interview process. This helps identify areas for improvement and maintain a positive candidate experience.

To provide further context on optimizing the interview process, the following table outlines best practices:

Fintech Interview Process Optimization

Best practices for different interview stages and role types are outlined below to illustrate how a well-structured interview process can impact the quality of hire and overall candidate experience.

| Interview Stage | Duration | Focus Areas | Key Questions | Success Metrics |

|---|---|---|---|---|

| Initial Screening | 15-30 minutes | Basic qualifications, cultural fit | Tell me about your experience in fintech. Why are you interested in this role? | Candidate engagement, qualification match |

| Technical Interview | 1-2 hours | Technical skills, problem-solving | Describe a technical challenge you faced and how you overcame it. | Technical proficiency, problem-solving abilities |

| Team Interview | 1 hour | Cultural fit, team dynamics | How do you approach teamwork and collaboration? | Teamwork skills, communication style |

| Final Interview | 1-2 hours | Leadership skills, long-term potential | Where do you see yourself in 5 years? Describe your leadership style. | Leadership potential, career aspirations |

This table summarizes the key elements of a successful interview process, highlighting the focus areas, key questions, and success metrics for each stage. By adhering to these best practices, fintech companies can significantly improve their chances of attracting and retaining top talent.

By implementing these strategies, fintech companies can create a highly effective recruitment process that attracts, evaluates, and secures top talent. Investing in a strong interview process is a direct investment in your company’s future.

Measuring Success and Optimizing Your 2.0 Recruitment Strategy

Effective recruitment for fintech companies requires continuous evaluation and improvement. This means tracking key metrics and adapting your strategies based on data and market trends. By analyzing your recruitment performance, you can identify bottlenecks, optimize sourcing channels, and ultimately improve your hiring outcomes.

Key Metrics for Fintech Recruitment

Tracking the right metrics provides valuable insights into the effectiveness of your recruitment efforts. These metrics help you understand where your process excels and where it needs improvement. This data-driven approach enables more informed decision-making.

- Time-to-Hire: This measures the time it takes to fill a position, from the moment it’s posted to when the offer is accepted. A shorter time-to-hire can reduce costs and ensure you secure top talent before competitors.

- Cost-per-Hire: Calculating the total cost of filling a position helps you evaluate the efficiency of your recruitment process. This includes advertising costs, recruiter fees, and internal resources allocated to hiring.

- Candidate Satisfaction: Measuring candidate experience through surveys or feedback forms provides valuable information about how candidates perceive your company and the recruitment process. A positive candidate experience enhances your employer brand and can attract top talent.

- Retention Rate: Tracking employee retention, particularly within the first year, provides insights into your onboarding process and overall employee satisfaction. High retention rates indicate a positive work environment and effective talent management.

For instance, if your time-to-hire is excessively long, it could indicate bottlenecks in your interview process or sourcing strategy. Similarly, low candidate satisfaction scores might suggest a need to improve communication or streamline the application process.

Building Feedback Loops

Gathering feedback from both successful hires and candidates who decline offers is essential for optimizing your approach. This valuable information can reveal hidden weaknesses in your process and suggest areas for improvement.

- Successful Hires: Regular check-ins with new hires can provide insights into what attracted them to the role and how you can improve the onboarding experience. This also helps build strong relationships with new team members.

- Declined Offers: Understanding why candidates decline offers can provide crucial information about your competitiveness in the market. This feedback can help you adjust your compensation, benefits, or even the role itself.

For example, feedback might reveal that candidates are declining offers due to a lack of remote work options or concerns about career development opportunities. This feedback helps adapt your strategies to attract top talent.

Establishing Benchmarks and Adapting Strategies

Setting benchmarks for your recruitment performance allows you to track your progress and identify areas for improvement over time. This allows you to measure your success against industry standards and your own historical data.

- Industry Benchmarks: Comparing your metrics to industry averages helps you understand how your company performs relative to competitors. This provides valuable context for evaluating your recruitment effectiveness.

- Internal Benchmarks: Tracking your own historical data lets you identify trends and measure the impact of changes in your recruitment strategies. This data-driven approach allows for ongoing refinement and optimization.

Furthermore, creating systems for adapting your approach based on market changes and candidate feedback is crucial for long-term success. The fintech industry is constantly evolving, so your recruitment strategies must remain flexible and responsive. This ongoing adaptation is key to staying competitive in the talent market.

By consistently measuring success, gathering feedback, and adapting your strategies, you can build a highly effective recruitment process that consistently delivers top talent for your fintech company. This continuous improvement approach will help you stay ahead and attract the best professionals in the industry.

Ready to transform your fintech recruitment strategy and access top talent in Latin America? Nearshore Business Solutions connects US companies with skilled remote professionals, helping you build a world-class team without the hassle of traditional hiring. Visit Nearshore Business Solutions today to learn more.