Costa Rica has emerged as a preferred destination for companies aiming to hire in Costa Rica and expand their remote teams with access to a highly skilled workforce. Renowned for its stable economy, strategic location, and robust digital infrastructure, Costa Rica offers numerous advantages for businesses seeking to hire and operate in Latin America.

This guide covers all the essential aspects to hire in Costa Rica, including different hiring methods, labor laws, payroll, taxes, and compliance. Whether you’re a startup looking to hire your first Costa Rican contractor or a larger company aiming to establish a local presence, this guide will help you navigate Costa Rica’s hiring landscape effectively when you hire in Costa Rica.

Key Statistics on Hiring in Costa Rica (2026)

| Statistic | Details |

|---|---|

| Official Language | Spanish (high English proficiency, especially in business and tech sectors) |

| Time Zone | GMT-6 (Central Standard Time equivalent, no Daylight Saving Time) |

| Currency | Costa Rican Colón (CRC) |

| Population | Approximately 5.1 million |

| Major Talent Hubs | San José, Heredia, Alajuela, Cartago |

| Internet Penetration | Over 85% with widespread high-speed connectivity in urban and suburban areas |

| Labor Force | Approximately 2.4 million, with growing focus on tech, shared services, and bilingual customer support |

| Literacy Rate | 97% |

| STEM Graduates | Approximately 25,000 annually |

Why Hire in Costa Rica?

Costa Rica has emerged as one of Latin America’s premier destinations for hiring skilled professionals. The country combines a highly educated workforce, robust digital infrastructure, and strong cultural alignment with North American business practices. Here’s why Costa Rica should be on your radar for building remote teams:

Cost Savings

Costa Rica offers exceptional value without sacrificing quality. Companies can access skilled professionals at 40-60% lower costs compared to hiring in North America or Europe. This cost advantage applies across roles—from software developers and data analysts to customer support specialists and digital marketers—while maintaining the high standards international companies require.

Skilled Workforce

Costa Rica’s 2.4 million-strong labor force is highly educated and technically proficient. The country prioritizes education, with a 97% literacy rate and universities producing approximately 25,000 STEM graduates annually in fields like engineering, computer science, information technology, and business administration.

Key talent hubs include:

- San José: The capital and largest tech ecosystem

- Heredia: Home to major multinational operations and a growing startup scene

- Alajuela: Emerging tech and business services hub

- Cartago: Strong engineering and technical talent base

Costa Rican professionals excel in:

- Software development and engineering

- Data analytics and business intelligence

- Bilingual customer support (Spanish/English)

- Digital marketing and content creation

- Shared services and back-office operations

- Quality assurance and testing

Time Zone Alignment

Costa Rica operates on GMT-6 (Central Standard Time equivalent) with no Daylight Saving Time, providing:

- Perfect alignment with U.S. Central Time

- 1-hour difference with U.S. Eastern Time

- 2-hour difference with U.S. Pacific Time

- Excellent overlap for real-time collaboration with North American teams throughout the workday

Digital Infrastructure

With over 85% internet penetration and widespread high-speed connectivity in urban and suburban areas, Costa Rica supports seamless remote work. The country has invested heavily in telecommunications infrastructure, ensuring reliable connectivity for distributed teams and digital operations.

Government Support and Incentives

The Costa Rican government actively supports foreign investment and technology development through:

- Free Trade Zones (FTZs): Offer significant tax incentives, simplified regulatory processes, and customs benefits for qualifying companies

- Costa Rica Green and Digital Strategy: Government initiative focused on expanding digital infrastructure, promoting technology education, and positioning the country as a regional tech hub

- CINDE (Costa Rican Investment Promotion Agency): Provides support for foreign companies establishing operations, including assistance with permits, talent recruitment, and market entry

- Stable democracy and economy: Costa Rica is known for political stability, strong institutions, and a business-friendly regulatory environment

Cultural Compatibility

Costa Rican work culture aligns closely with North American and European business standards, making integration smooth for international teams:

- High English proficiency: Particularly strong in tech, customer support, and business sectors, facilitating seamless communication with global teams

- Professional work ethic: Costa Rican professionals are known for reliability, collaboration, and customer service orientation

- Western business practices: Familiar with agile methodologies, remote work tools, and international corporate standards

- “Pura Vida” mentality: Costa Rica’s positive, solution-oriented culture translates into resilient, adaptable team members who thrive in remote environments

Quality of Life and Talent Retention

Costa Rica consistently ranks high in quality of life indices, which supports talent retention:

- Political stability and low crime rates in business districts

- Universal healthcare system

- Strong environmental protections and natural beauty

- No standing army since 1949, with resources redirected to education and healthcare

This combination of professional opportunities and quality of life makes Costa Rica attractive for retaining top talent long-term, reducing turnover costs for employers.

Key Job Categories and In-Demand Roles in Costa Rica

Costa Rica’s labor market offers a diverse range of highly skilled professionals across sectors critical to modern business operations. The country’s emphasis on education, bilingual capabilities, and technological advancement has created a talent pool that excels in both technical and service-oriented roles. Here’s a comprehensive look at the most sought-after positions when you hire in Costa Rica:

1. Software Development and Engineering

Costa Rica’s tech sector has matured significantly over the past two decades, supported by multinational tech companies establishing regional hubs and a growing startup ecosystem. The country’s universities and technical institutes produce thousands of technology professionals annually, many with hands-on experience in modern development frameworks, cloud technologies, and agile methodologies.

Frontend Developers

- React, Angular, and Vue.js specialists

- UI/UX-focused developers with design system experience

- Progressive Web App (PWA) developers

- Accessibility and responsive design experts

Backend Developers

- Node.js, Python (Django/Flask), and Java (Spring Boot) developers

- RESTful API and GraphQL specialists

- Microservices architecture experts

- Database administrators (PostgreSQL, MySQL, MongoDB)

Full-Stack Developers

- MERN/MEAN stack developers

- .NET developers (C#, ASP.NET Core)

- Ruby on Rails developers

- PHP/Laravel specialists

Mobile App Developers

- Native iOS developers (Swift, SwiftUI)

- Native Android developers (Kotlin, Java)

- Cross-platform developers (React Native, Flutter)

- Mobile security specialists

DevOps and Cloud Engineers

- AWS, Azure, and Google Cloud platform specialists

- CI/CD pipeline engineers

- Kubernetes and Docker experts

- Site Reliability Engineers (SRE)

- Infrastructure as Code (Terraform, CloudFormation)

Quality Assurance Professionals

- Manual QA testers

- Automation engineers (Selenium, Cypress, Playwright)

- Performance and load testing specialists

- Security and penetration testing experts

2. Customer Support and Success

Costa Rica has established itself as a premier nearshore destination for customer support operations, thanks to its neutral Spanish accent, high English proficiency, and service-oriented culture. The country’s GMT-6 time zone provides seamless alignment with North American business hours, making it ideal for companies serving U.S. and Canadian customers.

Customer Service Representatives

- Bilingual support agents (English/Spanish)

- Technical support specialists

- Omnichannel support professionals (phone, chat, email, social media)

- Tier 1, Tier 2, and Tier 3 support agents

- Help desk specialists

Customer Success Professionals

- Customer success managers

- Client onboarding specialists

- Account managers and relationship coordinators

- Retention and renewal specialists

- Customer training and education coordinators

Virtual Assistants and Administrative Support

- Executive assistants

- Calendar and email management specialists

- Data entry and CRM management professionals

- Research assistants

- Travel and logistics coordinators

3. Shared Services and Business Process Outsourcing (BPO)

Costa Rica is a regional leader in shared services centers, with many Fortune 500 companies operating finance, HR, and operations hubs in the country. This has created a deep talent pool experienced in standardized processes, compliance, and global business operations.

Finance and Accounting Shared Services

- Accounts payable/receivable specialists

- General ledger accountants

- Financial reporting analysts

- Tax compliance specialists

- Payroll processing experts

HR Shared Services

- Benefits administration specialists

- Payroll coordinators

- Recruitment process outsourcing (RPO) professionals

- HR data and reporting analysts

- Employee relations specialists

Back-Office Operations

- Document processing specialists

- Claims processing agents

- Order management specialists

- Invoice processing professionals

- Data validation and quality control experts

4. Finance and Accounting

Costa Rican finance professionals are known for their attention to detail, understanding of international accounting standards (US GAAP, IFRS), and ability to navigate both local and global financial regulations. Many professionals hold international certifications such as CPA, CMA, or ACCA.

Accounting Professionals

- Staff accountants and senior accountants

- Controllers and assistant controllers

- Tax accountants with international tax expertise

- Bookkeepers proficient in QuickBooks, Xero, and NetSuite

- Audit and compliance specialists

Financial Analysts

- Financial planning and analysis (FP&A) professionals

- Budget analysts and forecasting specialists

- Financial modelers

- Business intelligence analysts

- Investment analysts

- Treasury specialists

5. Sales and Business Development

Costa Rican sales professionals bring strong communication skills, cultural awareness, and customer-centric approaches that resonate with North American and international markets. Many have experience working with U.S.-based companies and understand cross-border business dynamics.

Sales Development Representatives (SDRs)

- Outbound prospecting specialists

- Lead generation and qualification experts

- Cold calling and email outreach professionals

- CRM management specialists (Salesforce, HubSpot, Pipedrive)

Account Executives and Sales Managers

- B2B and B2C sales closers

- Enterprise and mid-market account executives

- Territory sales representatives

- Sales team leads and managers

- Channel and partner sales specialists

Business Development Professionals

- Partnership development managers

- Market expansion strategists

- Strategic alliance coordinators

- Revenue operations specialists

6. Marketing and Creative Services

Costa Rica’s bilingual marketing professionals combine analytical thinking with creative execution, making them valuable for companies targeting both English and Spanish-speaking markets. The country’s creative sector has grown alongside its tech industry, producing skilled digital marketers and content creators.

Digital Marketing Specialists

- Performance marketing and growth marketing experts

- Marketing automation specialists (HubSpot, Marketo, Pardot)

- Email marketing managers

- Conversion rate optimization (CRO) specialists

- Marketing analytics professionals

SEO and SEM Experts

- Organic search specialists

- Google Ads and PPC campaign managers

- Local and international SEO strategists

- Technical SEO analysts

- E-commerce SEO specialists

Social Media Professionals

- Social media managers and strategists

- Community managers

- Paid social advertising specialists (Meta, LinkedIn, TikTok)

- Social media content creators

- Influencer marketing coordinators

Content Creators and Designers

- Bilingual copywriters (English/Spanish)

- Content strategists and managers

- Video editors and motion graphics designers

- Graphic designers and brand specialists

- Podcast producers and audio editors

7. Data and Analytics

As businesses increasingly rely on data-driven decision-making, Costa Rican universities have responded by producing graduates with strong quantitative skills and expertise in modern data tools and methodologies.

Data Professionals

- Data analysts and business intelligence analysts

- Data engineers

- Data scientists

- Business analysts

- Database developers and architects

- ETL developers

Analytics Specialists

- Product analysts

- Marketing analytics specialists

- Web analytics experts (Google Analytics, Adobe Analytics)

- Statistical analysts

- Reporting and dashboard specialists (Tableau, Power BI, Looker)

8. Human Resources and People Operations

Costa Rican HR professionals have developed expertise in managing distributed teams, implementing people-first cultures, and navigating the complexities of international employment—skills highly valuable in today’s remote work environment.

HR Specialists and Generalists

- Talent acquisition specialists and technical recruiters

- HR business partners

- Employee relations specialists

- Compensation and benefits analysts

- HR compliance and labor law specialists

People Operations Professionals

- Onboarding and offboarding coordinators

- Learning and development specialists

- Performance management experts

- Employee engagement managers

- HRIS administrators (Workday, BambooHR, ADP)

- Diversity, equity, and inclusion (DEI) coordinators

9. Operations and Project Management

Costa Rican operations professionals bring strong organizational skills, process optimization expertise, and experience managing complex projects across multiple time zones and cultural contexts.

Project Managers

- Agile/Scrum masters

- Technical project managers

- PMO (Project Management Office) specialists

- Program managers

- Product owners

- Certified PMP professionals

Operations Coordinators and Managers

- Operations analysts

- Process improvement and Six Sigma specialists

- Supply chain coordinators

- Logistics and distribution specialists

- Inventory and procurement managers

10. Design and User Experience

Costa Rica’s design community has gained recognition for its user-centered approach and creative problem-solving, producing designers who understand both local and international user needs.

Design Professionals

- UI/UX designers

- Product designers

- Visual and brand designers

- Interaction designers

- Design researchers and user researchers

- Prototyping specialists (Figma, Sketch, Adobe XD)

- Design system architects

Why These Roles Thrive in Costa Rica

The diversity and quality of talent available when hiring in Costa Rica stems from several key factors:

Strong Educational Infrastructure: Costa Rica invests heavily in education, with a 97% literacy rate and universities producing approximately 25,000 STEM graduates annually. Institutions like the Instituto Tecnológico de Costa Rica (TEC), Universidad de Costa Rica (UCR), and CENFOTEC specialize in technical and business education aligned with industry needs.

Mature Multinational Presence: For over two decades, companies like Intel, Amazon, P&G, HP, IBM, and Boston Scientific have operated major facilities in Costa Rica, creating a talent pool experienced in global business practices, quality standards, and corporate operations.

Bilingual Excellence: Costa Rica has prioritized English education for decades, resulting in strong bilingual capabilities across the workforce, particularly in professional and technical roles. This makes communication seamless for North American and European companies.

Free Trade Zone Benefits: Costa Rica’s Free Trade Zone program has attracted technology, manufacturing, and services companies, creating employment opportunities and professional development in specialized fields.

Time Zone Advantage: GMT-6 alignment with U.S. Central Time ensures real-time collaboration throughout the workday, eliminating the challenges of asynchronous communication.

Cultural Alignment: Costa Rican professionals share business values with North American companies, including punctuality, accountability, customer service orientation, and collaborative work styles.

Cost-Effective Excellence: Salaries in Costa Rica typically range from 40-60% lower than comparable U.S. positions while maintaining high quality standards, offering exceptional value without compromising on talent quality.

Stable Environment: As the most stable democracy in Central America with no standing army since 1949, Costa Rica offers political stability, strong institutions, and a safe business environment.

These factors combine to make Costa Rica an ideal destination for companies seeking to build remote teams, establish nearshore operations, or expand their global talent footprint. Whether hiring for technical roles, customer-facing positions, or operational support, Costa Rica offers a mature, skilled, and culturally compatible talent pool capable of meeting diverse business needs.

Monthly Salary Ranges for when you hire in Costa Rica (USD)

The following salary ranges reflect typical compensation for professionals in Costa Rica as of 2026. These figures represent gross monthly salaries before taxes and do not include mandatory employer contributions or benefits. Actual salaries may vary based on experience level, specific skills, company size, and location.

| Role | Junior/Entry-Level | Mid-Level | Senior/Expert |

|---|---|---|---|

| Software Development & Engineering | |||

| Frontend Developer | $1,200 – $1,800 | $1,800 – $2,800 | $2,800 – $4,500 |

| Backend Developer | $1,300 – $2,000 | $2,000 – $3,000 | $3,000 – $5,000 |

| Full-Stack Developer | $1,400 – $2,100 | $2,100 – $3,200 | $3,200 – $5,200 |

| Mobile Developer | $1,300 – $2,000 | $2,000 – $3,200 | $3,200 – $5,000 |

| DevOps Engineer | $1,500 – $2,200 | $2,200 – $3,500 | $3,500 – $5,500 |

| QA Engineer/Tester | $1,000 – $1,500 | $1,500 – $2,500 | $2,500 – $4,000 |

| Customer Support & Success | |||

| Customer Service Representative | $800 – $1,200 | $1,200 – $1,800 | $1,800 – $2,500 |

| Technical Support Specialist | $1,000 – $1,500 | $1,500 – $2,200 | $2,200 – $3,200 |

| Customer Success Manager | $1,200 – $1,800 | $1,800 – $2,800 | $2,800 – $4,200 |

| Virtual Assistant | $700 – $1,100 | $1,100 – $1,600 | $1,600 – $2,300 |

| Finance & Accounting | |||

| Staff Accountant | $1,000 – $1,500 | $1,500 – $2,300 | $2,300 – $3,500 |

| Financial Analyst | $1,200 – $1,800 | $1,800 – $2,800 | $2,800 – $4,200 |

| Controller | $1,800 – $2,500 | $2,500 – $3,800 | $3,800 – $5,500 |

| Accounts Payable/Receivable | $800 – $1,200 | $1,200 – $1,800 | $1,800 – $2,500 |

| Sales & Business Development | |||

| Sales Development Rep (SDR) | $900 – $1,400 | $1,400 – $2,000 | $2,000 – $3,000 |

| Account Executive | $1,200 – $2,000 | $2,000 – $3,200 | $3,200 – $5,000+ |

| Business Development Manager | $1,500 – $2,200 | $2,200 – $3,500 | $3,500 – $5,500+ |

| Marketing & Creative | |||

| Digital Marketing Specialist | $1,000 – $1,600 | $1,600 – $2,500 | $2,500 – $4,000 |

| SEO/SEM Specialist | $1,100 – $1,700 | $1,700 – $2,600 | $2,600 – $4,200 |

| Social Media Manager | $900 – $1,400 | $1,400 – $2,200 | $2,200 – $3,500 |

| Content Creator/Copywriter | $900 – $1,400 | $1,400 – $2,200 | $2,200 – $3,500 |

| Graphic Designer | $900 – $1,400 | $1,400 – $2,200 | $2,200 – $3,500 |

| Data & Analytics | |||

| Data Analyst | $1,200 – $1,800 | $1,800 – $2,800 | $2,800 – $4,500 |

| Data Engineer | $1,400 – $2,100 | $2,100 – $3,200 | $3,200 – $5,000 |

| Data Scientist | $1,500 – $2,300 | $2,300 – $3,500 | $3,500 – $5,500 |

| Business Analyst | $1,100 – $1,700 | $1,700 – $2,600 | $2,600 – $4,000 |

| Human Resources | |||

| HR Specialist | $1,000 – $1,500 | $1,500 – $2,300 | $2,300 – $3,500 |

| Recruiter/Talent Acquisition | $1,000 – $1,500 | $1,500 – $2,300 | $2,300 – $3,500 |

| HR Manager | $1,500 – $2,200 | $2,200 – $3,300 | $3,300 – $5,000 |

| Operations & Project Management | |||

| Project Manager | $1,300 – $2,000 | $2,000 – $3,000 | $3,000 – $4,800 |

| Operations Manager | $1,400 – $2,100 | $2,100 – $3,200 | $3,200 – $5,000 |

| Scrum Master/Agile Coach | $1,300 – $2,000 | $2,000 – $3,000 | $3,000 – $4,500 |

| Design & UX | |||

| UI/UX Designer | $1,100 – $1,700 | $1,700 – $2,700 | $2,700 – $4,200 |

| Product Designer | $1,200 – $1,900 | $1,900 – $3,000 | $3,000 – $4,800 |

Note: These ranges are estimates based on market research and may vary by:

- Company size and industry: Multinational corporations and tech companies typically pay at the higher end

- Location: San José and Heredia generally offer higher salaries than other regions

- Specific technical skills: Specialized skills (e.g., AI/ML, blockchain, cybersecurity) command premium rates

- Language proficiency: Bilingual professionals (English/Spanish) often earn 15-30% more

- Benefits and bonuses: Many roles include performance bonuses, commissions (especially sales), and comprehensive benefits packages

Salaries are typically paid in Costa Rican Colones (CRC) but are often benchmarked against USD rates due to the country’s internationalized economy.

3 Ways to Hire in Costa Rica

When it comes to hiring talent and deciding how to hire in Costa Rica, businesses have three main options: engaging contractors, utilizing Employer of Record (EOR) services, or forming a local legal entity. Each approach has its own set of advantages, compliance requirements, and cost considerations.

1. Hiring Contractors in Costa Rica

Hiring contractors in Costa Rica is often the simplest way to quickly bring on talent, especially for short-term or project-based work when you hire in Costa Rica. Contractors operate as self-employed individuals, managing their own taxes and benefits.

PROS

- Flexibility: Perfect for short-term projects or roles with variable workloads

- Cost-Effective: No obligation to provide benefits like health insurance, pensions, or paid time off

- Simplicity: Minimal paperwork, with no need for a local legal entity

CONS

- Compliance Risks: Misclassifying employees as contractors can lead to legal and financial penalties

- Limited Control: Less control over contractors compared to full-time employees

- Lack of Benefits: May not attract top talent seeking stability and benefits

Key Considerations: When hiring contractors in Costa Rica, it’s crucial to have a detailed contract outlining the scope of work, payment terms, and confidentiality clauses. Companies must also ensure compliance with Costa Rican regulations that differentiate contractors from employees to avoid potential misclassification issues.

2. Employer of Record (EOR) Services to Hire in Costa Rica

An Employer of Record (EOR) acts as the legal employer of your Costa Rican staff, allowing you to hire in Costa Rica with full-time employees without needing to set up a legal entity. The EOR manages payroll, taxes, benefits, and compliance on your behalf.

PROS

- Compliance: The EOR ensures adherence to local labor laws, taxes, and benefits regulations

- Quick Onboarding: Facilitates fast hiring without navigating complex legal and administrative processes

- Reduced Administrative Burden: The EOR handles all HR, payroll, and benefits administration

CONS

- Service Fees: EOR services charge a monthly fee per employee, increasing operational costs

- Less Direct Control: The EOR is the legal employer, requiring some decisions to go through them

Key Considerations: Using an EOR is an excellent choice if you want to test the Costa Rican market or hire in Costa Rica with a small number of employees. It offers flexibility and compliance without the need for local incorporation.

3. Entity Formation When You Hire in Costa Rica

Setting up a local entity in Costa Rica provides complete control over hiring employees directly and managing operations. This approach is ideal for companies planning a long-term presence when they hire in Costa Rica.

PROS

- Full Control: Directly manage hiring, payroll, benefits, and employment terms

- Brand Presence: Build a stronger local brand and presence in the Costa Rican market

- Long-Term Strategy: Ideal for businesses aiming to scale operations and hire a larger workforce

CONS

- Time-Consuming: Establishing an entity can take months and requires compliance with legal, tax, and registration processes

- Higher Costs: Includes upfront registration, legal fees, and ongoing compliance expenses

- Complexity: Requires navigating Costa Rica’s legal and regulatory environment, including tax filings and labor laws

Key Considerations: Forming an entity is a strategic move for companies committed to a long-term investment when they hire in Costa Rica. You’ll need to register the business, obtain a Tax Identification Number (TIN), and comply with ongoing financial reporting and tax obligations.

Labor Laws and Employment Contracts When You Hire in Costa Rica

Understanding Costa Rica’s labor laws is essential for compliant hiring and maintaining positive employer-employee relationships when you hire in Costa Rica. The country’s labor framework provides clear guidelines for employment contracts, employee rights, and employer obligations that create stability for both parties.

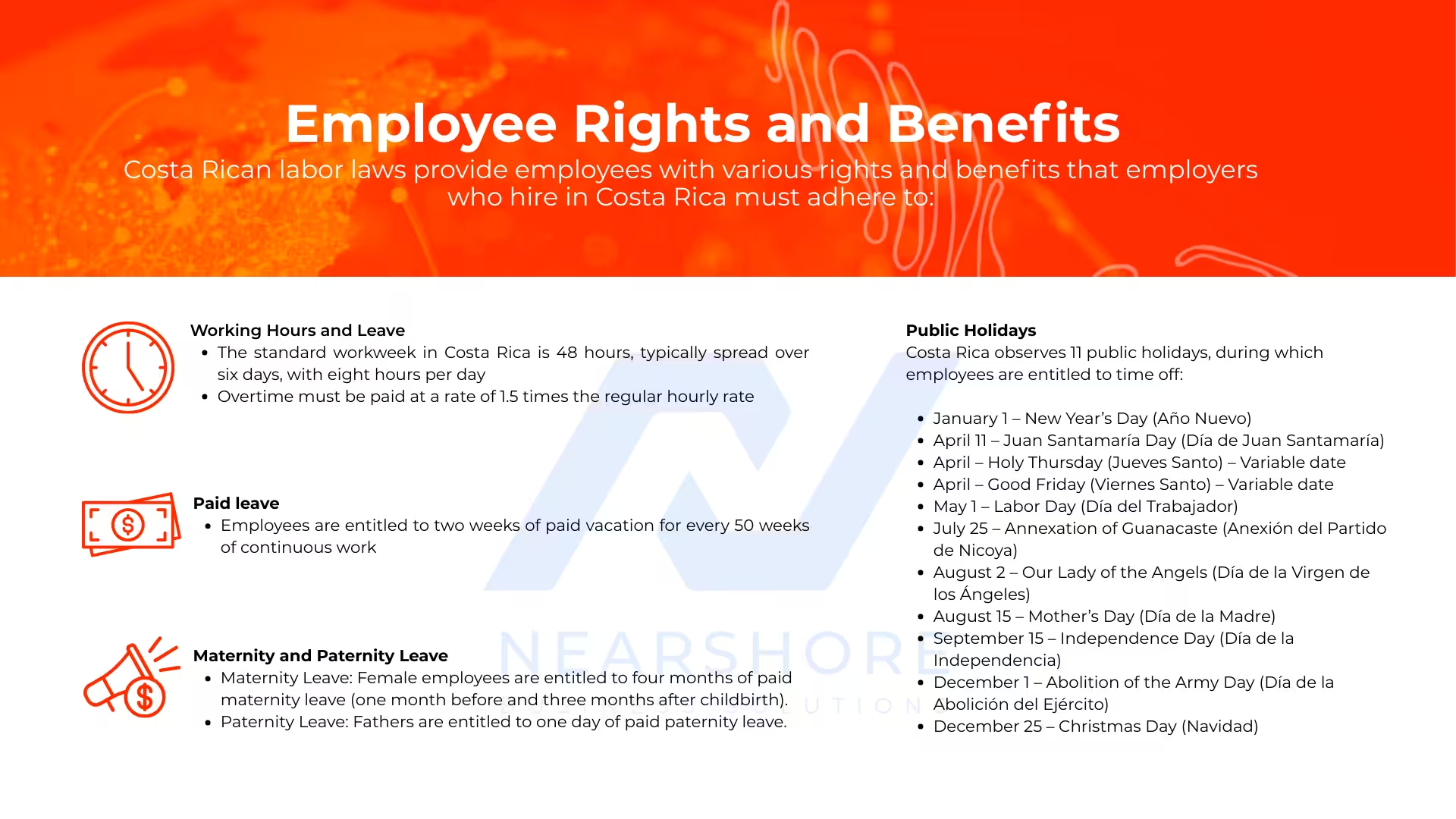

Employee Rights and Benefits

Mandatory Social Security Contributions

When you hire in Costa Rica, both employers and employees must contribute to the country’s comprehensive social security system. For health insurance, employers contribute 9.25% of the employee’s monthly salary while employees contribute 5.5%. These contributions provide access to Costa Rica’s universal healthcare system through the Costa Rican Social Security Fund (CCSS).

Pension contributions ensure retirement security, with employers contributing 5.08% and employees contributing 4.33% of monthly salary. Additionally, employers must pay workmen’s compensation insurance ranging from 0.5% to 1.5% of salary, depending on the job’s risk level. This insurance protects employees in case of workplace accidents or injuries.

Termination and Severance

Costa Rican labor law provides specific guidelines on termination procedures when you hire in Costa Rica. Understanding these requirements helps employers navigate separations properly and avoid legal complications.

Termination with just cause does not require severance payments but demands proper documentation. Just cause includes serious misconduct, theft, repeated poor performance, or other significant violations. Employers must maintain thorough records to support just cause claims.

Termination without just cause requires both a notice period and severance payment. The notice period (preaviso) varies based on tenure: one week for employees with 3-6 months of service, two weeks for those with 6 months to one year, and one month for employees with more than one year of service.

Severance pay (cesantía) also scales with tenure when you hire in Costa Rica. Employees with 3-6 months receive seven days of salary, those with 6 months to one year receive 14 days, and those beyond the first year receive 19.5 days of salary per year of service, capped at eight years maximum.

Payroll and Compensation When You Hire in Costa Rica

Managing payroll correctly is crucial when you hire in Costa Rica to ensure compliance with local regulations and maintain employee satisfaction. Costa Rica’s compensation system includes several mandatory components that employers must understand and implement.

Salary Structure

The base salary forms the foundation of employee compensation when you hire in Costa Rica and must meet or exceed the national minimum wage, which stands at approximately 330,000 CRC (around $620 USD) per month for most job categories as of 2026. This minimum varies slightly by industry and position type, so employers should verify requirements for their specific roles.

One of Costa Rica’s most distinctive compensation requirements is the 13th month bonus, known locally as “aguinaldo.” This mandatory year-end bonus equals one-twelfth of the total salary earned by the employee during the year and must be paid by December 20th annually. Companies that fail to pay aguinaldo face penalties and legal consequences when you hire in Costa Rica.

Many employers also provide allowances for transportation or meals, depending on the nature of the job and company policies. While not always mandatory, these allowances are common in certain industries and help attract quality talent.

Payment Cycles and Timing

When you hire in Costa Rica, salaries are typically paid on a monthly basis, though some companies opt for bi-monthly payments every 15 days. The chosen payment schedule must be clearly specified in the employment contract to avoid confusion. Regardless of cycle, employers must ensure timely payments and accurate handling of all mandatory deductions for social security, health insurance, and pension contributions.

Taxes and Legal Compliance When You Hire in Costa Rica

Navigating tax obligations is a critical aspect when you hire in Costa Rica. The country maintains a structured tax system that applies to both businesses and employees, with specific requirements for foreign companies operating locally.

Corporate Tax Obligations

Companies operating in Costa Rica face several tax obligations. Corporate income tax follows a progressive rate structure ranging from 10% to 30% based on annual gross income. Businesses earning up to 5 million CRC (approximately $9,400 USD) annually are taxed at the lowest 10% rate, while those with earnings exceeding 106 million CRC (around $200,000 USD) face the highest 30% rate.

The standard Value-Added Tax (VAT) rate in Costa Rica is 13%, applied to most goods and services. Some basic necessities may qualify for reduced rates or exemptions. Additionally, local municipal taxes apply based on business activities within specific jurisdictions, typically calculated as a small percentage of gross income.

Employment Tax Requirements

When you hire in Costa Rica, employers must handle income tax withholding from employee salaries based on Costa Rica’s progressive income tax rates, which range from 0% to 25% depending on the employee’s income level. This withholding must be calculated accurately and remitted to tax authorities on schedule.

Social security contributions represent another major tax obligation when you hire in Costa Rica. As detailed earlier, employers contribute 9.25% for health insurance and 5.08% for pensions, while managing employee withholdings of 5.5% and 4.33% respectively. These contributions must be remitted regularly to the Costa Rican Social Security Fund (CCSS).

All businesses must register for a Tax Identification Number (TIN) with the Costa Rican Ministry of Finance (Ministerio de Hacienda) to manage these tax obligations properly and operate legally in the country.

Company Formation to Hire in Costa Rica

For businesses planning to establish a long-term presence when you hire in Costa Rica, forming a local legal entity provides full operational control and enables direct employment relationships. Understanding the available business structures and registration process helps companies make informed decisions.

Choosing Your Business Entity

When you hire in Costa Rica through a local entity, the Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L.) serves as the most popular choice for small to medium-sized businesses. This structure requires a minimum of two partners, with each partner’s liability limited to their capital contributions. The S.R.L. offers simplicity and flexibility, making it attractive for foreign companies entering the Costa Rican market.

The Corporation (Sociedad Anónima – S.A.) represents a more complex structure commonly used by larger companies. It requires at least two shareholders and provides limited liability protection with more formal governance requirements. Companies planning to scale significantly or eventually go public typically choose the S.A. structure when you hire in Costa Rica.

Foreign companies can also establish a branch office (Sucursal) in Costa Rica, allowing them to operate as a legal entity without forming an entirely new corporation. This option maintains closer ties to the parent company while enabling local operations.

Registration Process

Setting up a legal entity to hire in Costa Rica involves several steps. First, companies must choose and verify their company name through the National Registry (Registro Nacional) to ensure availability and avoid conflicts with existing businesses.

Next, the Articles of Incorporation must be drafted and signed before a notary public. These articles outline the company’s operational structure, management hierarchy, and governance policies. The documentation must then be submitted to the National Registry for official registration.

After registration approval, companies obtain a Tax Identification Number (TIN) from the Costa Rican Ministry of Finance (Ministerio de Hacienda), which is essential for all tax-related activities. Finally, opening a corporate bank account completes the setup process, enabling the company to conduct business operations and manage payroll when you hire in Costa Rica.

The entire registration process typically takes several weeks to complete. Working with local legal or accounting firms can help navigate complexities and ensure full compliance with Costa Rican regulations.

Employer of Record (EOR) Services to Hire in Costa Rica

For companies wanting to hire in Costa Rica without the time and expense of establishing a legal entity, Employer of Record (EOR) services provide an efficient alternative that enables rapid market entry while maintaining full compliance.

An EOR becomes the legal employer of your Costa Rican staff, managing all aspects of payroll, benefits administration, tax withholding, and regulatory compliance on your behalf. Meanwhile, you retain complete control over daily work activities, assignments, and performance management when you hire in Costa Rica through this model.

The primary advantages include quick market entry—often within days rather than the weeks or months required for entity formation—and comprehensive compliance with Costa Rican labor laws without needing in-house expertise. Companies avoid entity setup costs and reduce administrative burden significantly, making EOR solutions particularly attractive for businesses testing the Costa Rican market or maintaining small teams.

While EOR services include service fees that add to the total cost when you hire in Costa Rica, they remain cost-effective compared to establishing and maintaining a local entity, especially for companies with fewer than 10-15 employees or those in exploratory market phases.

Conclusion

Costa Rica has established itself as a premier destination for companies looking to hire in Costa Rica and build skilled remote teams in Latin America. With a highly educated workforce (97% literacy, 25,000+ STEM graduates annually), exceptional English proficiency, and seamless time zone alignment (GMT-6), Costa Rica delivers unmatched talent quality and accessibility.

The country’s Free Trade Zone incentives, political stability, and robust digital infrastructure (85%+ internet penetration) create an ideal environment for international businesses. Cultural alignment with North American business practices ensures smooth integration, while cost savings of 40-60% compared to the U.S. make expansion financially strategic.

Whether you choose to hire in Costa Rica through independent contractors, an Employer of Record (EOR) for rapid deployment, or by establishing a local entity (S.R.L. or S.A.) for long-term operations, the country’s business-friendly framework and comprehensive labor protections support successful hiring at every stage. Understanding key requirements—including the 13th-month bonus (Aguinaldo), social security contributions, and termination procedures—ensures compliant operations and positive employee relationships.

Frequently Asked Questions About Hiring in Costa Rica

1. How much does it cost to hire in Costa Rica?

The cost to hire in Costa Rica is competitive within Latin America while maintaining high quality standards. The minimum wage varies by job category but averages approximately 330,000 CRC ($565 USD) per month as of 2026. Skilled professionals in technology, engineering, and customer service typically earn between $1,000-$4,500 USD monthly depending on experience and specialization.

Employers must budget for mandatory costs including:

- 14.33% social security contributions (9.25% health + 5.08% pension)

- 0.5-1.5% workmen’s compensation (varies by risk level)

- 13th-month bonus (Aguinaldo) paid annually by December 20th

Total employment costs are 40-60% lower than North America, making Costa Rica an attractive nearshore destination.

2. What is the best way to hire employees in Costa Rica?

The best way to hire in Costa Rica depends on your business timeline and commitment level:

- Employer of Record (EOR): Ideal for rapid market entry without a legal entity. Handles all compliance, payroll, and benefits within days.

- Independent Contractors: Offers flexibility and simplicity for project-based or short-term work.

- Local Entity (S.R.L. or S.A.): Recommended for long-term operations with multiple employees and full operational control.

Most companies start with an EOR to test the Costa Rican market before committing to entity formation.

3. Can I hire remote workers in Costa Rica without a local entity?

Yes, you can hire in Costa Rica without establishing a local entity by using an Employer of Record (EOR) or hiring independent contractors.

An EOR acts as the legal employer, managing all compliance including payroll, taxes, social security contributions (health and pension), and mandatory benefits like the 13th-month bonus (Aguinaldo) while you direct daily work. This allows you to compliantly hire full-time employees within 3-7 business days.

Contractors work as self-employed individuals, though proper classification is critical to avoid misclassification penalties and legal liability.

4. What are the key labor laws when hiring in Costa Rica?

Key labor laws when you hire in Costa Rica include:

- Standard workweek: 48 hours across six days

- Paid vacation: Two weeks per 50 weeks worked

- Public holidays: 11 paid national holidays

- Maternity leave: 4 months paid (1 month before, 3 months after childbirth)

- Paternity leave: 1 day paid

- Severance pay (without just cause): 7 days to 19.5 days of salary per year worked

- Mandatory contributions: 9.25% health insurance, 5.08% pension (employer portion)

- 13th-month bonus (Aguinaldo): Must be paid by December 20th annually

- Written contracts: Required for all employment relationships

5. How long does it take to hire employees in Costa Rica?

Timeline varies by hiring method:

- EOR: 3-7 business days once candidates are selected

- Contractors: 1-3 days after contract agreement

- Local entity setup: 6-12 weeks, including name registration, drafting articles of incorporation, registering with the National Registry, obtaining a Tax Identification Number (TIN), and opening a corporate bank account. After entity setup, individual hiring proceeds within 1-2 weeks.

6. What is the minimum wage in Costa Rica?

The minimum wage in Costa Rica varies by job category and is set by the Ministry of Labor. As of 2026, most categories require approximately 330,000 CRC (around $565 USD) per month.

However, skilled professionals in high-demand sectors—technology, software development, engineering, bilingual customer support, and digital marketing—typically earn significantly above minimum wage, ranging from $1,000-$4,500 USD monthly depending on experience, specialization, and language proficiency.

Costa Rica’s educated workforce with 97% literacy and 25,000+ annual STEM graduates commands competitive regional salaries while remaining cost-effective compared to North American markets.

7. Do I need to pay taxes when I hire in Costa Rica?

Yes, when you hire in Costa Rica, you must comply with several tax obligations:

Employer contributions:

- Health system (CCSS): 9.25%

- Pension: 5.08%

- Workmen’s compensation: 0.5-1.5%

Employee withholdings:

- Health: 5.5%

- Pension: 4.33%

- Income tax: Progressive rates of 0-25% based on income level

Entity taxes (if applicable):

- Corporate income tax: Progressive rates of 10-30%

- VAT: 13% on goods and services

All taxes must be remitted to the Ministry of Finance. An EOR handles all these obligations on your behalf when you hire in Costa Rica.

8. What are the benefits of hiring in Costa Rica vs. other Latin American countries?

Costa Rica offers unique advantages:

- Highest literacy rate in Central America: 97% with 25,000+ STEM graduates annually

- Perfect time zone alignment: GMT-6 matches U.S. Central Time for seamless collaboration

- Exceptional English proficiency: Especially strong in business and tech sectors

- Government support: Free Trade Zones provide tax incentives and regulatory simplifications

- Political stability: Most stable democracy in Central America

- Digital infrastructure: 85%+ internet penetration with high-speed connectivity

- Cultural alignment: Strong compatibility with North American business practices

- Quality of life: Attracts and retains top talent

- Cost savings: 40-60% lower than North America

Conclusion

Costa Rica has established itself as a premier destination for companies looking to hire in Costa Rica and build skilled remote teams in Latin America. With a highly educated workforce (97% literacy, 25,000+ STEM graduates annually), exceptional English proficiency, and seamless time zone alignment (GMT-6), Costa Rica delivers unmatched talent quality and accessibility.

The country’s Free Trade Zone incentives, political stability, and robust digital infrastructure (85%+ internet penetration) create an ideal environment for international businesses. Cultural alignment with North American business practices ensures smooth integration, while cost savings of 40-60% compared to the U.S. make expansion financially strategic.

Whether you choose to hire in Costa Rica through independent contractors, an Employer of Record (EOR) for rapid deployment, or by establishing a local entity (S.R.L. or S.A.) for long-term operations, the country’s business-friendly framework and comprehensive labor protections support successful hiring at every stage. Understanding key requirements—including the 13th-month bonus (Aguinaldo), social security contributions, and termination procedures—ensures compliant operations and positive employee relationships.

How Can We Help You?

Whether you’re hiring your first role in Colombia or scaling an entire team, we support U.S. companies at every stage of the hiring journey:

- Remote Talent Recruitment – End-to-end recruiting for remote hires in Colombia, including market benchmarking, vetting, and candidate selection.

- In-Country Recruitment – Local, country-specific recruitment for companies building teams directly in Colombia.

- Recruitment as a Service (RaaS) – An embedded recruiting model where our team operates as an extension of yours to support ongoing or multi-role hiring needs.

- Staff Augmentation – Dedicated nearshore talent that integrates directly into your workflows, allowing you to scale teams quickly and predictably.

Ready to get started?

Tell us what roles you’re hiring for, and we’ll help you understand market availability, salary ranges, and the best hiring model for your team.